Webscalers ramp up push into telecom in 1Q21

Webscalers ramp up push into telecom in 1Q21

MTN Consulting’s formal review of 4Q20 performance for the webscale sector will be published within a week. Based on preliminary stats, it is clear that the webscale market of operators continued blockbuster growth in 2020, ending the year with just over $1.7 trillion in revenues, from $1.45T in 2019. The growth is due to several factors: acquisitions (e.g. Alibaba-Sun Art, Amazon-Zoox, and Microsoft-Zenimax); strong digital advertising spend (e.g. Google up 9% YoY to $146.9B), and increased cloud spending across a number of verticals amidst the COVID-19 pandemic.

Webscalers have been attacking the telco vertical for several years. Since the close of 4Q20, over the last three months the webscale sector’s efforts to engage telcos have picked up steam. A number of telcos have recently announced new deals with webscalers in the areas of edge computing, service development, digital transformation, and workload shift. At the same time, more traditional suppliers to telcos (e.g. Nokia) have expanded their own collaboration with the cloud providers who dominate the webscale market. These deals aim to differentiate among traditional telco vendors, prevent webscalers growing too fast in the market, and save costs for telcos. What follows is a brief outline of some of the key developments in 1Q21.

Telco deals with webscalers

Key deals from 1Q21 include the following.

Telefonica has engaged IBM, classified as a webscale operator in our coverage, to act as a systems integrator for an open RAN trial in Argentina. The proof of concept includes software and hardware components from Altiostar, Red Hat (an IBM subsidiary), Quanta, Gigatera, and Kontron. SDx Central notes that the trial follows on recent work between IBM and Telefonica on an overhaul of the telco’s enterprise-focused cloud platform (“Cloud Garden 2.0”)

TIM Brasil announced it would work with Oracle and Microsoft to migrate all of its on-premises workloads to the cloud. Capacity Media notes that the telco will “leverage Oracle Cloud Infrastructure (OCI) and Microsoft Azure, to move its mission-critical applications to the cloud, optimising and simplifying management of its IT infrastructure, as well as improving scalability and agility.”

SK Telecom made several announcements in 1Q21:

- The company will connect its 5G mobile edge computing services with 34 other telcos across multiple regions via the Bridge Alliance.

- With Dell Technologies and its subsidiary VMWare, SK Telecom will create a technology called OneBox MEC to combine private wireless capabilities with an edge computing platform.

- In early January, the Korean telco announced the launch of SKT 5GX Edge in collaboration with Amazon Web Services. The service allows its customers to build mobile applications that require ultra-low latency, according to Capacity Media.

South African provider Vodacom Business announced that it was certified as “the first” AWS partner in Africa to attain the AWS Outposts Ready designation. Vodacom clients can purchase datacenter managed services from both Vodacom and AWS, choosing a mix of private cloud on-premises, Vodacom data center hosting, public cloud using a local AWS availability zone, or a combination of multiple options.

Telecom Egypt has selected IBM and its Red Hat unit to develop an open hybrid cloud strategy. Per Computer Weekly, the largest telco in Egypt “has implemented IBM Cloud Pak for Automation to infuse artificial intelligence (AI) into its workflows to provide the flexibility to scale automation projects quickly, across any cloud or on-premise environment.”

Google Cloud announced a win at Canada’s Telus billed as a 10-year strategic alliance. The two will co-develop “new services and solutions that support digital transformation within key industries, including communications technology, healthcare, agriculture, security, and connected home.” The collaboration will also target network modernization within Telus’ operations. Telus will use GCP’s managed application platform, Anthos, to support 5G services and mobile edge computing.

Singtel announced it would offer 5G edge computing over the Microsoft Azure cloud platform. Trials will start later this year, and ultimately allow Singtel clients to run applications such as autonomous vehicles, drones, robots, and VR/AR with very low latency.

Australia’s Optus, a unit of Singtel, signed a 3-year partnership with Google Cloud to transform its customer support operations, using GCP’s Contact Center AI solution.

Globe Telecom in the Philippines announced it would use AWS to accelerate its own digital transformation and improve customer experience. Per the Manila Standard, Globe has “migrated carrier-grade and mission-critical applications, including contact center operations, customer analytics, network and service assurance systems and infrastructure operations, monitoring, and security, from its on-premises data centers to AWS.” That includes transitioning 3,000 customer service agents from a legacy Avaya solution to Amazon Connect.

Liberty Global’s Belgium unit, Telenet, announced vendors for its 5G rollout in March which include Ericsson, Nokia and Google Cloud. Ericsson won the radio access, and Nokia the core. Nokia will leverage Google Cloud’s Anthos for Telecom platform in Telenet data centers. Liberty says the Anthos platform will provide “the innovation infrastructure with solutions and applications for 5G users, to drive better customer experiences and service.”

Telecom-focused vendors partnering with cloud providers

Nokia was by far the most active of telco-focused vendors in 1Q21, announcing several collaborations with the webscale sector.

In January, Nokia announced a partnership with GCP to develop cloud-native 5G core solutions. Nokia is supplying its voice core, cloud packet core, network exposure function, data management, and 5G core, while GCP’s Anthos for Telecom platform will serve as the platform for deploying applications. In March, Nokia expanded its work with GCP, announcing it would also partner to develop cloud-based 5G radio solutions. The collaboration leverages Nokia’s RAN, Open RAN, Cloud vRAN and edge cloud technologies with GCP’s edge computing platform and application ecosystem. Initial efforts center around Cloud RAN, and aim at integrating Nokia’s 5G virtualized distributed unit and virtualized centralized unit with Google’s edge computing platform running on Anthos. Nokia aims to certify its AirFrame Open Edge hardware with Anthos.

At the same time as the March GCP announcement, Nokia announced deals with Microsoft and Amazon.

The Microsoft agreement will develop “new market-ready 4G and 5G private wireless use cases designed for enterprises”, combing Nokia’s Cloud RAN, Open RAN, radio access controller, and multi-access edge cloud technologies with the Azure Private Edge Zone.

With Amazon Web Services, Nokia and AWS will conduct joint R&D into enabling Nokia’s RAN, Open RAN, Cloud RAN, and edge solutions to operate “seamlessly” with AWS Outposts. The goal is to develop new customer-focused 5G solutions. Per Nokia, “operators will be able to simplify the network virtualization and platform layers for the Core and RAN network functions by leveraging the agility and scalability of cloud.” Ultimately Nokia will be able to leverage Amazon services like EC2, EKS, Local Zones and others to help automate network functions and deploy end customer applications.

Intel, which has attacked the telco market aggressively over the last few quarters, signed a deal with GCP in February to develop “reference architectures and integrated solutions” for telcos to enable 5G and edge network solutions. The collaboration involves three main aspects: virtualized RAN and open RAN solution development; a network functions validation lab; and, service delivery to the edge.

Israeli telco vendor Radcom announced the integration of its 5G assurance solution (ACE) with Microsoft Azure. Radcom says that the integration of ACE with Azure “enables operators to assure the quality of 5G services by leveraging AI and machine learning-driven assurance and automation” ACE runs as a cloud native function over the Azure Kubernetes Service.

Vendor collaborations with webscalers will continue throughout 2021, no doubt. Mavenir’s SVP for Business Development, John Baker, addressed this trend indirectly in a January interview with SDx Central: “I really do believe the hyperscalers are going to become the new telecom providers going forward…Apart from the physical radio that goes on a tower, everything we’re doing now follows the data center model, and these guys know how to manage data centers, software, and applications.”

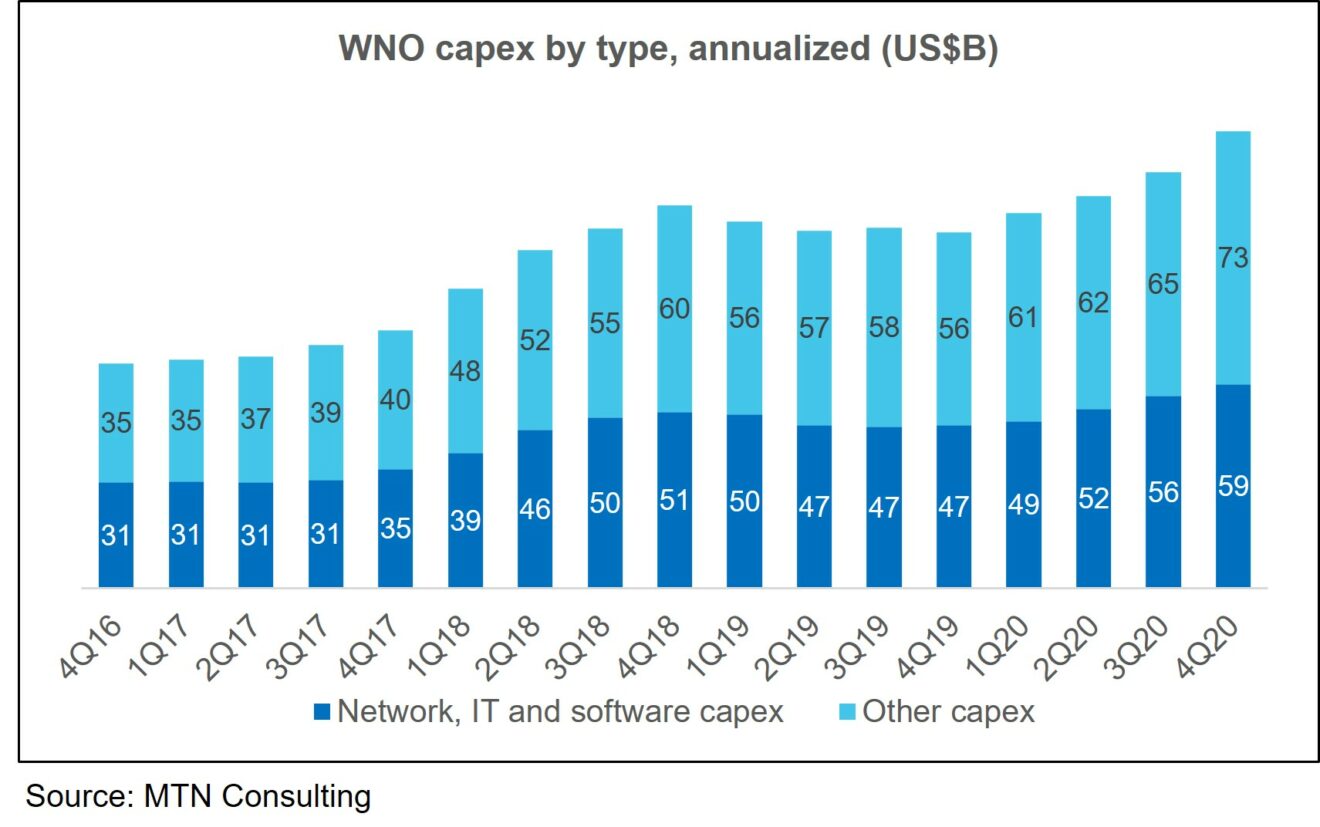

For webscale operators to support all these new activities requires heavy investment in network infrastructure. The figure below shows capex by type, on an annualized basis, for the total webscale network operator market since 2016.