By Matt Walker

This brief is focused on the carrier-neutral network operator (CNNO) sector. CNNOs sell independent, carrier-neutral access to network infrastructure, including bandwidth (fiber), data center and tower/small cell assets. The biggest CNNOs by revenues are China Tower, American Tower, Equinix, Crown Castle, Level 3 (a Lumen subsidiary), Digital Realty, Cellnex, NBN Australia, Indus Towers (ex-Bharti Infratel), and Zayo. In the most recent 12 months (3Q22-2Q23), the CNNO market represented $96.7 billion in revenues (+2.7% YoY), $34.8B in capex (+9.4% YoY), $8.8B in M&A spend (-68.9% YoY), and $251.1B of net plant (+2.3% YoY). CNNOs employed about 113.7K people at the end of June 2023, up 4.8% YoY.

After a weak second half 2022 (2H22), the CNNO sector has begun to improve in 2023 with 3% and 5% revenue growth rates in the first two quarters, respectively. Higher interest rates have slowed M&A and forced CNNOs to manage debt more carefully, but capex outlays remain high at over 35% of revenues. CNNOs continue to optimize their footprint and scale, spinning off and buying or building assets accordingly. One example: Cogent bought a portfolio of old switching centers from Sprint in late 2022 and is converting some to small colocation centers. CNNOs are increasing their focus on minimizing power costs – or at least limiting the impact of price rises – and gearing up their sustainability efforts.

For growth, we expect CNNOs to attack two important opportunities. First: support the telco need to densify their mobile networks; that means more small cell/DAS and metro fiber infra, but also more macro tower sites. Densification was required with 4G, but 5G requires even more in order to achieve its latency and speed goals. China Tower, as an example, expanded its in-building DAS coverage to 8,820 million square meters in 2Q23, up by 48% YoY. Second: support the tech sector’s explosion of interest in generative AI (“GenAI”), by building facilities and offering services that match these new needs. DigitalBridge, for example, argues that AI is a “cloud-scale opportunity” and that “access to digital infra…at the lowest total cost, is a key success factor.” CNNOs specialize in “access to digital infra” so this is a big opportunity for data center CNNOs. The big webscalers investing in GenAI will surely also want to build their own facilities, especially for model training, but CNNOs like Digital Realty and Equinix have roles to play with model implementation (i.e. inference).

- Table Of Contents

- Figures and Tables

- Coverage

- Visuals

Table Of Contents

- Summary – page 2

- Revenues up 4%, Capex up 15% YoY in the 1H23 period – page 2

- Free cash flow margin slides over the last few quarters; net margin is negative – page 5

- Generative AI opens up new opportunities for data center players – page 6

- 5G requires densification in the mobile RAN, creating CNNO opportunities – page 8

- Outlook – page 9

- Appendix – page 10

Figures and Tables

Figure 1: YoY growth rates for single quarter revenues and capex, CNNOs

Figure 2: CNNOs’ net PP&E on the books alongside capex and M&A spending

Figure 3: Annualized revenues ($B) and capital intensity for CNNO sector

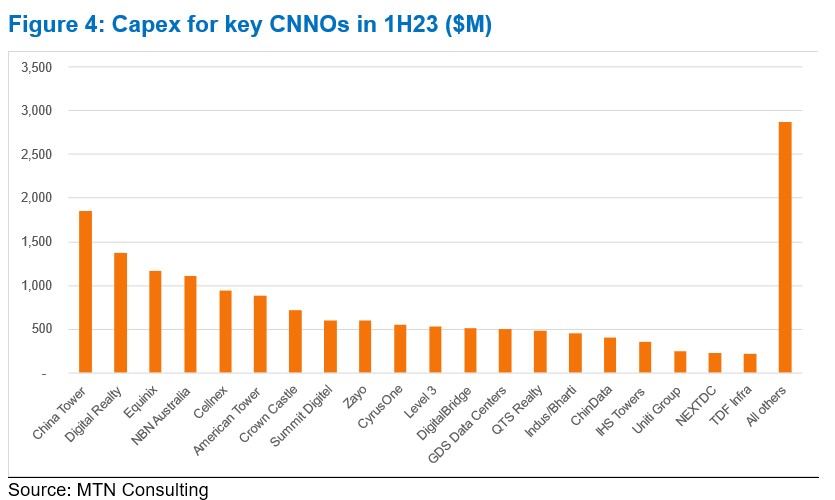

Figure 4: Capex for key CNNOs in 1H23 ($M)

Figure 5: Recent profitability margins for CNNO sector, annualized

Figure 6: Top and bottom CNNOs based on annualized FCF margin in 2Q23

Figure 7: Implications of GenAI for data center requirements in CNNO market

Figure 8: Densification solutions for improved coverage, per American Tower

Figure 9: China Tower’s in-building DAS coverage, millions of square meters

Coverage

Operators covered:

21Vianet

American Tower

Balitower

Bharti Infratel

Cellnex

China Tower

ChinData

Chorus Limited

CK Hutchison

Cogent

Crown Castle

CyrusOne

Cyxtera

Digital Realty

DigitalBridge

EI Towers

Equinix

GDS Data Centers

GTL Infrastructure

Helios Towers

IBS Towers

IHS Towers

Internap

Inwit

Keppel DC REIT

Level 3

NBN Australia

NEXTDC

QTS Realty

SBA Communications

SMN (Protelindo)

Summit Digitel

Sunevision

Superloop

TDF Infrastructure/Arcus

Telesites

Tower Bersama

Uniti Group

Zayo

Visuals