By Matt Walker and Arun Menon

This brief report reviews actual capex through June 2024 and the full-year outlook for key companies in three segments of communications network operators: telco, webscale and carrier-neutral.

MTN Consulting tracks communications network operator spending (capex) closely. Each quarter, we publish detailed Excel reviews for the telco & webscale markets. For carrier-neutral, we update our database informally each quarter and publish a detailed review once a year. For all three, we usually publish a market forecast twice a year: around December and around July. This year, our July update was postponed as we believed the market was too volatile to make publication of a new forecast feasible. That turned out to be a good decision. For example, interest rates now appear to be set to fall, which will support more telco capex and also entice some market consolidation (e.g. Verizon-Frontier). That gives more support to the presumption that telco spending will change directions after 2H24. Also, there is more support now for our thesis that GenAI is overly hyped and cannot sustain continued capex spikes.

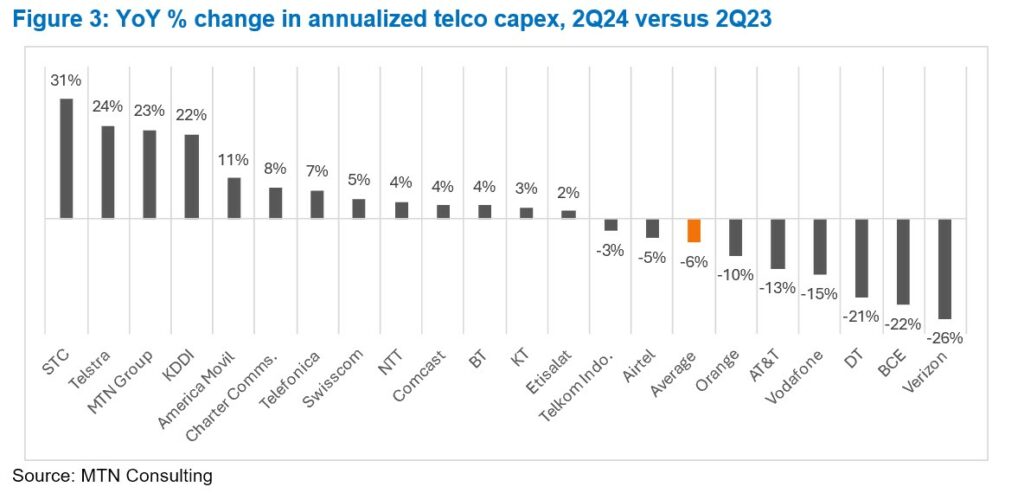

We now plan to release an update around the end of 3Q24. As part of the update process, we expect to publish a number of shorter reports reviewing various aspects of the forecast. The starting point is a review of actual capex through 2Q24 and the latest guidance from key operators. That is the purpose of this report. As discussed below, webscale capex surged by over 50% YoY in 2Q24, carrier-neutral capex grew by about 20% YoY, but telco capex remains on the decline. That’s where it has been for several straight quarters, recording YoY declines in the 5-10% range. The telco weakness is not a shock given the need to ramp down spending post 5G rollouts, and given the flat nature of the telecom industry. Moreover, we have long expected the cloud providers AWS, Azure and GCP to play a much larger role in telco networks, eventually. That is starting to happen as the cloud providers blend their solutions with more traditional telco vendors like Amdocs and Ericsson. For AWS, Azure and GCP, their combined sales to telcos now exceed $2B per quarter, from about $1B per quarter two years ago. This enables capex reductions.

Other topics we plan to address in the coming weeks include: labor costs & automation; data center spending & supply chain dynamics; shifting vendor landscape & implications for spending patterns; and wildcard topics, such as China starting a war, Trump winning, and India emerging as real player in tech supply chains.

- Table Of Contents

- Figures and Tables

- Coverage

- Visuals

Table Of Contents

- Summary – page 2

- Capex results & outlook for key operators – page 2

- Webscale capex climbs 51% YoY in 2Q24 – page 2

- Carrier-neutral capex up by 19% YoY in 2Q24 – page 5

- Telco capex continued declining at a 5-10% YoY rate in 2Q24 – page 8

- Appendix – page 18

Figures and Tables

Figures:

- Figure 1: YoY % change in annualized capex for key webscalers, 2Q24

- Figure 2: Annualized capex for key CNNOs in 2Q24, YoY % change

- Figure 3: YoY % change in annualized telco capex, 2Q24 versus 2Q23

Coverage

Organizations mentioned:

Abu Dhabi National Oil Company

Accenture

Airtel

Alphabet

Amazon

AMD

Amdocs

America Movil

American Tower

AT&T

BCE

BT

Calix

Cellnex

Charter Communications

China Mobile

Ciena

Comcast

CoreSite

Deutsche Telekom

Digital Realty

DigitalBridge

Equinix

Ericsson

Etisalat

Fastweb

Frontier Communications

Intel

KDDI

KT

Meta (FB)

Microsoft

MTN Group

Nokia

NTT

NVIDIA

Oracle

Orange

PIF

PTCL

STC

Swisscom

TAWAL

Telefonica

Telkom Indonesia

Telstra

Verizon

Vodafone

Zegona Communications

Visuals