By Matt Walker

This short brief is focused on data center demand and the role of generative AI in spurring an uptick in investments, particularly in the webscale sector. This brief supports our pending capex forecast update.

Generative AI (GenAI) in all its evolving flavors has captured the attention of the ‘investment community’ – there is a feeling that GenAI is a once in a lifetime opportunity where the early winners have the potential to dominate for decades. This has happened before with other technology breakthroughs and the hype usually dies down. Where is it going now? There is a strong argument that GenAI is a bubble which faces an uphill battle towards widespread adoption. The tools are interesting and do have a range of applications, but they also face serious legal challenges and lack a killer app. There’s also support for the idea that the “smart money” already believes this but doesn’t care, due to confidence in being able to sell others on the hype.

Last week a fund was announced to raise and manage up to $100 billion (B) in funding for AI data centers and related energy investments. The new fund, Global AI Infrastructure Investment Partnership (GAIIP), is a partnership between Microsoft and three financial institutions betting big on AI infrastructure: BlackRock, Global Infrastructure Partners (GIP), and Abu Dhabi-based MGX. The new partnership adds to a long list of private equity-driven investments in data centers announced over the last few years. These investments have spiked since late 2022, when ChatGPT was released. Even prior to GenAI rolling out in late 2022/early 2023, new investment vehicles were emerging to raise capital and manage investments in digital infrastructure. With GenAI gaining steam in 2024, that has accelerated.

It’s not news that data center spending is surging thanks to widespread enthusiasm for GenAI. The announcements keep on coming: new data centers, bigger and better, consuming more power. New financial vehicles arising to fund all this new infrastructure. With this, a more widespread appreciation of how power-hungry computers actually are – especially the massive clusters of computers prevailing in webscale data centers, now dominated by GPU servers. Energy consumption has doubled in the webscale sector since 2019, growing 15% per year in each of the last two years. More important, since COVID, the webscale sector has become more energy intensive, not less; in 2021, 59 MWh of energy was consumed per US$1M in revenues. That figure grew to 65 in 2022 and 70 in 2023. This is notable, as webscalers are supposed to be able to exploit their size in order to get efficiencies from scale; it’s going the opposite direction with data center power consumption. And energy intensity is likely to keep rising with big commitments to GenAI. Inadequate access to affordable, renewable power is one of many challenges faced by the GenAI market. Despite these challenges, data center spend is likely to remain elevated for a few quarters, driven by the webscale market. There is a race underway to train and evolve these new AI models. There is a feeling that the early winners will be able to preserve their advantage for many years. Hence there is a land grab underway: for skilled developers, for tools, for energy capacity, and for land.

- Table Of Contents

- Figures and Tables

- Coverage

- Visuals

Table Of Contents

- Summary – page 1

- Introduction – page 2

- Analysis – page 3

- Webscale capex surged in 1H24 and GenAI is driving strong outlook – page 3

- Top four webscalers drive data center developments – page 3

- Cloud may have started as a side business but it’s now big money – page 3

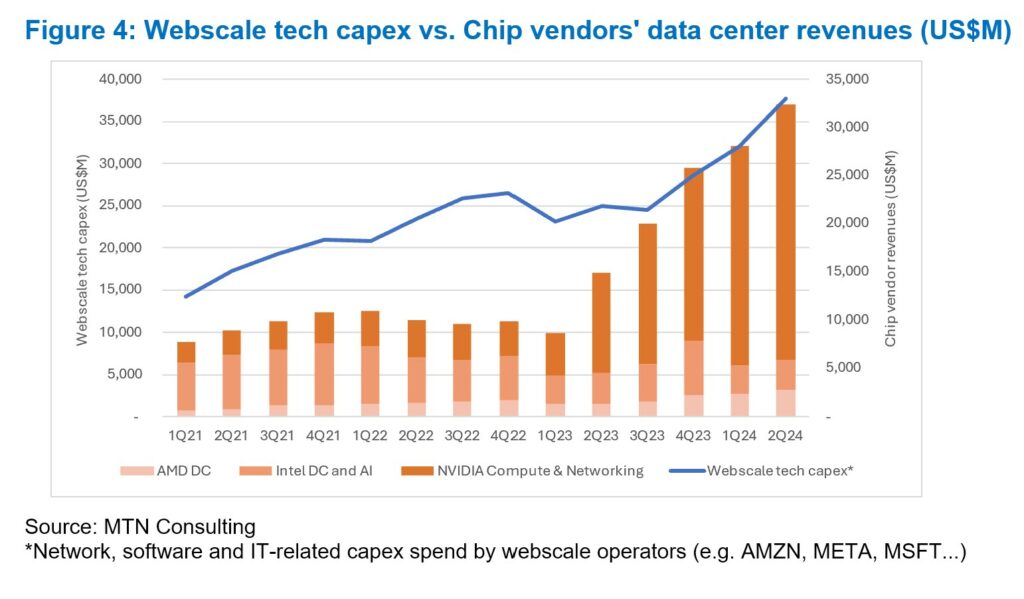

- Webscale tech capex closely tied to chip vendors’ data center revenues – page 5

- Energy consumption trends in webscale market are concerning – page 6

- Global politics and the US-China trade war will intervene – page 7

- Outlook – page 8

- Appendix – page 9

Figures and Tables

Figures:

- Figure 1: Webscale sector capex and free cash flow margin trends through 2Q24

- Figure 2: Big data center spenders (webscale and CNNO) – annualized capex and YoY % change

- Figure 3: Cloud service revenues as a percent of total for key webscalers, 2018-24

- Figure 4: Webscale tech capex vs. Chip vendors’ data center revenues (US$M)

- Figure 5: Energy intensity (MWh of energy consumption per $M in revenue)

Coverage

Organizations mentioned:

Alibaba

Alphabet/Google

Amazon

AMD

Apple

ASML

Baidu

BlackRock

Digital Realty

DigitalBridge

Equinix

Global AI Infrastructure Investment Partnership

Global Infrastructure Partners (GIP)

Huawei

Infinera

Intel

Meta (Facebook)

MGX

Microsoft

NVIDIA

Oracle

SAP

SMIC

Tencent

TSMC

Visuals