By Matt Walker

This short report is focused on the energy consumption and environmental policies of the world’s network operators. It presents data on energy demand, use of renewables, emissions, and energy efficiency efforts. This is an update of a report published in 2023 with new data and new analysis.

The world’s disparate efforts to address climate change are falling miserably short. Per the United Nations, current climate policies will result in global warming of more than 3.1C by the year 2100. That’s twice the level of warming agreed upon in the 2015 Paris Agreement. A quick scan of the world’s headlines will find many extreme weather events, population dislocations, and heavy economic damage already. If things continue, the planet will be less habitable for humans every year. Humanity will spend more time and money simply treading water – cleaning up after the last mega storm rather than putting economies on a more sustainable trajectory.

In theory, tech companies have an opportunity to lead in the fight against climate change. In practice, network operators are failing badly. Energy consumption continued to grow for the aggregate of the three segments in 2023. The growth rate dipped to 4% in 2023, from about 9% the previous three years. The slower growth is a plus, but: (1) revenues grew even more slowly, so energy intensity (consumption divided by revenue) increased slightly, and (2) a recent explosion of AI data center investment in the webscale sector will probably change the trendline in 2024.

How about renewables? There is nothing inherently bad about consuming energy, if it’s renewable and carbon free. Economies need energy to run, just as your car needs fuel. However, data from the telco sector is disconcerting. In 2023, renewables accounted for 19.9% of total energy consumed by telcos. This figure has been rising by year, up from 10.3% in 2019. But 20% is low, and many easy changes have been made already. Further, greenhouse gas emissions (GHG) from telcos were about 133.4 million tons in 2023, or 75 tons per $1M in revenues; both figures are roughly the same as in 2019. If telcos are going to meet their carbon neutrality goals anytime soon, they need to attack these emissions aggressively, and that will cost. As for webscalers, they have a high rate of renewable use. Yet it’s unclear if they will sustain this commitment now that they are on the GenAI bandwagon. For the third segment, carrier-neutral, it’s a mixed bag. Some CNNOs invest heavily in energy efficiency and renewables, and some brag about their green practices. Others largely ignore questions of sustainability. The CNNO sector has absorbed assets from other segments over the years, so their infrastructure can have a patchwork quality, with different standards and designs in different regions. Also, sometimes CNNOs buy assets that are known to be energy hogs using dirty energy. Moreover, many CNNOs are owned by private equity or similar asset management firms, and don’t publish financial data regularly, much less energy data. They face little to no public pressure to “go green.” With right wing conservatives taking power in the US, there will be even less pressure on such companies.

- Table Of Contents

- Coverage

- Figures & Tables

- Visuals

Table Of Contents

- Summary – page 1

- Operator energy consumption growth slows to 4% in 2023 – page 2

- Relative size of three market segments – page 2

- Energy a key input for network operators – page 2

- Energy consumption by operator type – page 3

- Energy intensity by operator type – page 5

- Renewable energy use and emissions – page 7

- Appendix – page 10

Coverage

Organizations mentioned:

A1 Telekom Austria

Alibaba

Alphabet

Amazon

America Movil

American Tower

AT&T

BCE

BT

Cellnex

Charter Communications

China Mobile

China Telecom

China Unicom

CK Hutchison

Cognizant

Comcast

Crown Castle

Deutsche Telekom

Digital Realty

DigitalBridge

EI Towers

Equinix

IBM

IHS Towers

Iliad SA

Indus

JD.com

KPN

LG Uplus

Liberty Global

Meta (FB)

Microsoft

MTN Group

NBN Australia

NTT

Orange

PCCW

Proximus

Quebecor

Rogers

Rostelecom

SAP

SK Telecom

SMN (Protelindo)

Swisscom

Tele2 AB

Telecom Italia

Telefonica

Telia

Telkom Indonesia

Telstra

Telus

Turkcell

Verizon

Vodafone

Yandex

Figures & Tables

Figure 1: Three operator segments and their shares of global total in 2023

Figure 2: Total energy consumption by operator type, GWh

Figure 3: Total energy consumption, YoY growth rate by segment

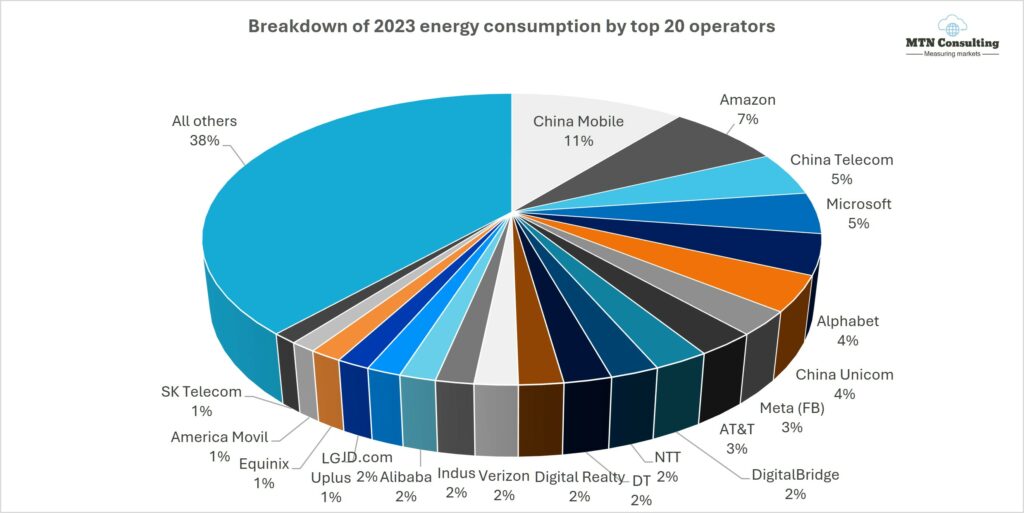

Figure 4: Breakdown of 2023 energy consumption by top 20 operators

Figure 5: Energy intensity by operator type (MWH per US$M revenue)

Figure 6: Energy intensity (MWh per $M in revenue): 2023 results for select operators

Figure 7: Biggest improvements (i.e. reductions) in energy intensity since 2019

Figure 8: Use of renewable energy in telecom, China v. rest of world

Figure 9: Top 20 telcos based on renewable energy use adoption rates (2023)

Figure 10: Use of renewable energy in telecom, China v. rest of world

Visuals