Connected cars: OEM car maker strategies – where does the network operator fit in?

Connected Car Emerging Tech Series Part 3

Author: Waseem Haider

Today’s car industry is not the same as it used to be, thanks to technology. OEMs are not only manufacturing cars but also developing software solutions for a more connected, personalized customer experience. The ever-evolving auto industry provides opportunities to OEMs to advent new revenue streams and to have more direct, ongoing relationships with their consumers. The changing landscape comes with its share of challenges for OEMs as they need to now focus on products and services outside of their core activities and try to improve profitability by selling connectivity as part of their overall offering.

OEMs are developing different strategies to reap the full benefit of the connected car opportunity. Some OEMs are working on their own ecosystem while others are developing partnerships with specialist vendors. The expanded connected car ecosystem plays a significant role in catering to the consumer demand of today and in the future. Among the different stakeholders in the ecosystem, the role of network operators – both telcos and webscalers – cannot be ignored. In this third part of the connected car tech series, we will talk about the strategies of OEM car manufacturers in the connected car space, and the role played by network operators.

OEM connected car strategies

As with any other industry, the digital transformation of the automotive industry poses a great challenge to OEMs. The digital world has pushed car manufacturers to become software companies selling a personalized customer experience to meet changing consumer demands. Future car buyers will not make it easy for OEMs as the world will move to autonomous vehicles with some drastic changes in consumers’ willingness to own a car. OEMs are aware of these challenges, and are implementing different strategies to keep their dominance in the connected car space despite competition from big tech companies.

In this section, let’s dive into some of the OEMs connected car strategies.

From the premium car manufacturers like BMW, Porsche, Audi, Mercedes etc. to the volume brands like Ford, Opel, Volvo etc., strategies differ based on relative dominance of the OEM, customer engagement, in-house capabilities, innovation, and investment in R&D. To simplify, let us group the OEM strategies in the connected car space into three main approaches:

- Developing In-house Capabilities

- Partnership/Building an Ecosystem

- Working with Global Industry Standards

1 – Developing In-house Capabilities

Big tech companies like Google, Facebook, and Amazon are at the forefront of connected car technology, putting Automotive OEMs in a difficult situation. As the expertise required for connected cars goes beyond the core business of OEMs, they are facing a big challenge to keep a dominant position in the ever-expanding ecosystem. Some of the OEMs are taking on these tech players directly by building in-house assets and capabilities for connected cars. One of most prominent OEMs who is realigning its strategy from car manufacturer to a software-driven mobility provider is Volkswagen.

Case Study: Volkswagen Connected Car Strategy

Volkswagen is reinventing itself into a digital mobility provider by investing heavily into several areas: software development, autonomous driving capabilities, electric vehicles’ battery technologies and other mobility services. With the new Group strategy “NEW AUTO – Mobility for Generations to Come”, the Volkswagen Group is realigning from a vehicle manufacturer to a leading, global software-driven mobility provider.

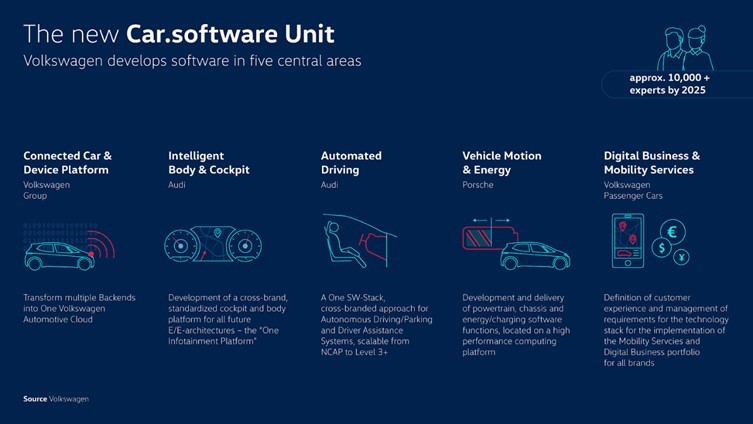

Volkswagen’s Car.Software group is central to this realignment (figure 1, below). The automotive giant is building its own end-to-end software platform with an in-car operating system (VW.OS), and capabilities aimed to enable the next generation of infotainment, vehicle performance, and passenger comfort as well as automated driving.

Figure 1: Volkswagen’s Car.Software organization

Source: Volkswagen

In addition, Volkswagen has announced a strategic partnership with Cubic Telecom and Microsoft to develop the Microsoft Connected Vehicle Platform (MCVP).

Together with Microsoft, VW hopes to accelerate the development of one of the largest dedicated automotive industry clouds, known as Volkswagen Automotive Cloud or VW.AC. Designed to provide a smart, scalable foundation for connected vehicles, VW.AC is expected to handle data from millions of vehicles per day, with the goal of delivering connected experiences to customers around the globe starting in 2022 – a key part of the Volkswagen Group strategy to become a leading automotive software innovator.

Volkswagen Group writes less than 10 percent of the software embedded in its vehicles, the rest of which is tied to third party-owned proprietary software. With efforts like the Car.Software Organisation and VW.AC, the Volkswagen Group aims to write 60 percent of the vehicle software by 2025, providing a truly integrated end-to-end software.

Where does the network operator fit in?

While Volkswagen is focused on in-house capabilities, its work with Microsoft makes clear that this strategy still involves network operators. Microsoft is one of the world’s largest “webscale network operators”, a tech company investing heavily in its own data centers, subsea cables, and related cloud infrastructure. It is possible that other types of operators may play a role in Volkswagen’s strategy over time, including telcos. Apart from providing connectivity, the operator is strongly positioned to offer cloud services, software and hardware solutions to supplement the OEM’s connected car in-house capabilities.

2 – Partnership/Building an Ecosystem

Some automotive OEMs are partnering with other OEMs by building global alliances to develop digital technologies for connected cars and future mobility services. One such global partnership is “The Alliance,” involving three OEM groups – Groupe Renault, Nissan Motor Company and Mitsubishi Motors Corporation – working together on future mobility technologies and solutions.

Where does the network operator fit in?

With this approach, three big OEMs are working with each other to develop connected car technologies and solutions. Telcos can be helpful partners in such alliances to provide technology software and solutions. As an example, the Renault-Nissan-Mitsubishi alliance is working together with Orange in the field of electric vehicles (EVs). Microsoft also plays a role in The Alliance, as discussed below.

Case Study: Renault-Nissan-Mitsubishi connected car strategy

The Alliance connected vehicle team is developing the Alliance Intelligent Cloud. Microsoft supports the Connected Vehicles Platform component of the Alliance Intelligent Cloud (figure 2, below). The Connected Vehicles Platform manages Alliance connectivity across all markets.

Figure 2: The Alliance Intelligent Cloud

Source: Microsoft

Microsoft is not the only Alliance partner. In September 2018, the Alliance signed a global multiyear agreement to partner with Google to equip Renault, Nissan, and Mitsubishi Motors vehicles with intelligent infotainment systems. The Alliance will utilize Android to offer customers a new array of services including Google Maps, the Google Assistant, and the Google Play Store.

These services will be combined with Alliance Intelligent Cloud-based remote software upgrades and vehicle diagnostics. By combining the latest technologies from the Alliance and Google, the Alliance member companies’ vehicles aim to have the most intelligent infotainment system in the market. Drivers and passengers can leverage Android capabilities to access an ecosystem that includes several existing applications and an expanding array of new apps. Per Microsoft, vehicles utilizing the Alliance Intelligent Cloud “will benefit from seamless access to the internet, providing enhanced remote diagnostics, continuous software deployment, firmware updates and access to infotainment services.”

The Alliance Intelligent Cloud is designed to leverage the combined scale of the three partners and Azure’s vast footprint. The Alliance cloud aims to consolidate multiple legacy connected vehicle solutions with future connected car features and business operations, and support mobility services. Features built into the connected platform include remote services, proactive monitoring, connected navigation, connected assistance, over-the-air software updates and other customer tailored services. As noted, The Alliance does leverage Google’s Android app ecosystem, but relies heavily on Microsoft for the cloud. The goal is for this partnership of OEMs to own, operate, and design their own intelligent cloud platform on Azure.

The Alliance Intelligent Cloud also aims to connect Alliance vehicles with future smart cities infrastructure, simplifying negotiations and technical development by providing a single point of contact.

3 – Influencing Global Industry Standards

Automotive OEMs are not anymore only manufacturing cars but are also new-age software companies which need to comply with standards. The challenge, though, is for OEMs there are hardly any global industry standards for connected cars. This lack of standards also creates an opportunity; those who write the standards often have a strong position in the market to follow. One strategy is ensuring you have a seat at the table when the standards are drafted.

To address the standards issue, OEMs together with other automotive vendors formed a non-profit alliance in 2009 – GENIVI. The alliance develops standard approaches for integrating operating systems and middleware present in the centralized and connected vehicle cockpit. The GENIVI platform consists of Linux-based core services (kernel, libraries), middleware and an open user interface. The goal is for this platform to form the basis upon which automobile manufacturers and their suppliers can establish a wide variety of products and services.

Notably, the alliance currently has no participation from the network operator side. The only exception is that Github has long been a member, and Github was acquired by Microsoft in 2018. Going forward, telcos and webscalers aiming to play a key role in the connected car market may need to participate in GENIVI.

Conclusion

Regardless of which connected car strategy is adopted, the common thread is that OEMs do not want to give away their dominant position to big tech players or new entrants. The three approaches discussed above should not be seen as exclusive. There are opportunities to combine one or more approaches with other innovative strategies. Network operators from both the telco and webscale/cloud world have opportunities to collaborate with OEMs, offering complementary solutions such as cloud services, software and hardware solutions along with the core asset of an operator, network connectivity.

Image source: Baidu