The world’s largest technology companies are investing heavily in webscale networks. These are centered around enormous webscale, also known as “hyperscale” data centers, and the web of infrastructure connecting them.

This webscale network operator (WNO) sector of companies spent $105.3B in the twelve-months ending 3Q19, or 7.5% of revenues. Nearly half of WNO capex is for the network (including capitalized software). Webscale operators spend even more on R&D each year than capex; annualized webscale R&D expenses in 3Q19 were 10.6% of revenues. This is in contrast to telecom operators, who rarely spend over 1% of revenues on R&D. WNOs use their R&D smarts to design their own network and equipment. Each company has its own approach, though. As the WNO sector grows, it is important to understand how WNOs blend internal expertise with procured technology from outside vendors to build their networks. Technology partnerships are crucial, as webscale providers generally prefer new, customized solutions to off the shelf alternatives.

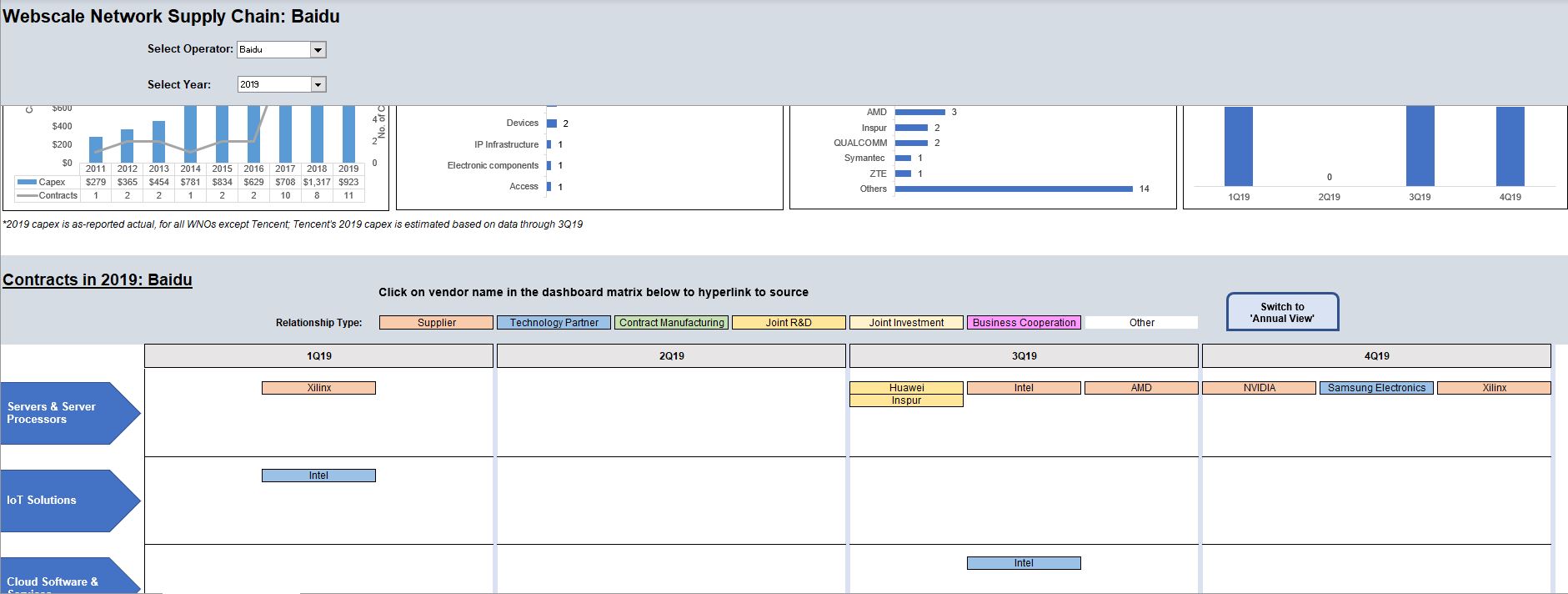

MTN Consulting’s “Webscale Network Supply Chain Analyzer” tracks technology spending in this sector by digging deep into the webscale-related supply chains of each operator. The Analyzer tracks contracts/deals between WNOs and technology vendors across eight product categories, and provides detail on type of relationship and nature of deal. The goal is to provide a comprehensive view of the competitive landscape facing vendors who aim to sell or partner with webscale operators.

In total, this database includes 558 entries through the end of December 2019. Contracts are concentrated in the 2016-19 period but stretch back to 2010. The vast majority of contracts involve one of the top 8 WNOs, who account for ~80% of total WNO capex. More companies are building webscale networks over time, though, and more vendors are selling to them. Our coverage will evolve with the sector.

File format: Excel

- Table of Contents

- Figure & Charts

- Visuals

Table of Contents

Index

- Introduction

- Coverage

- Terms of Use

Quarterly view:

- Contracts Summary

- Contracts Dashboard Matrix

- Contracts Data Table – All Contracts

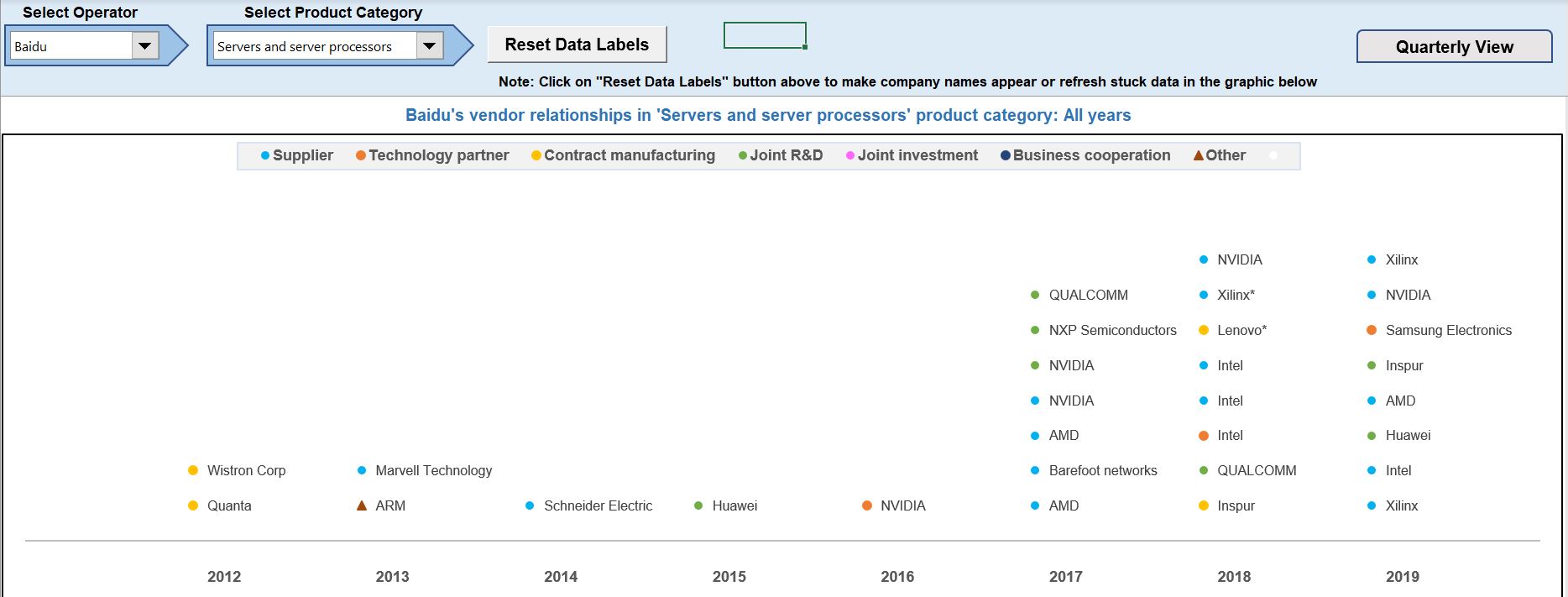

Annual view:

- Historical timeline of vendor relationships for a selected product category

- Data Table

About

- Global Network Infrastructure (GNI) Tracker

- Network Operator Coverage

- Methodology

Figure & Charts

- Capex and vendor contracts, 2011-2019

- Contracts by product: all years

- Top vendors, all years

- Contracts by quarter

- Dashboard matrix – Quarterly view

- Dashboard matrix – Annual view

Visuals