By Matt Walker

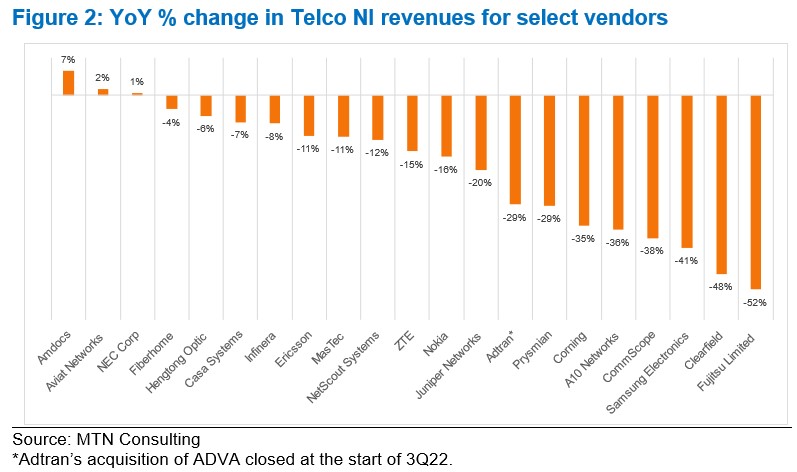

This comment provides an early review of 3Q23 market growth and spending metrics for the telecommunications operator (telco) market. MTN Consulting’s latest forecast called for $320B of telco capex in 2023, down only slightly from the $328B recorded in 2022. Early 3Q23 revenue reports from vendors selling into the telco market call this forecast into question. The dip in the Americas is worse than expected, and Asia’s expected 2023 growth has not materialized. Key vendors are reporting significant YoY drops in revenue, pointing to inventory corrections, macroeconomic uncertainty (interest rates, in particular), and weaker telco spending. Network infrastructure sales to telcos (Telco NI) for key vendors Ericsson and Nokia dropped 11% and 16% YoY in 3Q23, respectively, measured in US dollars. By the same metric, NEC, Fujitsu and Samsung saw +1%, -52%, and -41% YoY growth; Adtran, Casa, and Juniper declined 29%, 7%, and 20%; fiber-centric vendors Clearfield, Corning, CommScope, and Prysmian all saw double digit declines. MTN Consulting will update its operator forecast formally next month. In advance, this comment flags a weaker spending outlook than expected. Telco capex for 2023 is likely to come in around $300-$310B.

- Table Of Contents

- Figures and Tables

- Coverage

- Visuals

Table Of Contents

- Summary – page 1

- Introduction – page 1

- Analysis – page 2

- Telco capex reports

- Telco NI vendor earnings

- Outlook – page 4

- Appendix – page 5

Figures and Tables

Figure 1: Telco capex by region (US$B), 2020-24, per 7/23 forecast

Figure 2: YoY % change in Telco NI revenues for select vendors

Coverage

Organizations mentioned:

A10 Networks

Adtran

Alphabet (GCP)

Amazon Web Services (AWS)

Amdocs

Aviat Networks

Casa Systems

Clearfield

CommScope

Corning

Ericsson

Fiberhome

Fujitsu Limited

Hengtong Optic

Huawei

Infinera

Juniper Networks

MasTec

Microsoft (Azure)

NEC Corp

NetScout Systems

Nokia

Prysmian

Samsung Electronics

ZTE

Visuals