This report is the first in MTN Consulting’s series of country-level network studies, focused on Egypt. The objective of this report is to assess Egypt’s telecommunications market, addressing:

- Economic outlook and political environment

- Regulatory and policy issues

- Telco competitive landscape

- Telco network spending priorities

- Vendor landscape and emerging opportunities

Future deep dives in the series will focus on South Africa, Nigeria and the UAE; China, India, Korea, Japan, and Taiwan, the US, Canada, Mexico, and Brazil; and the UK, France, Germany and Russia.

———-

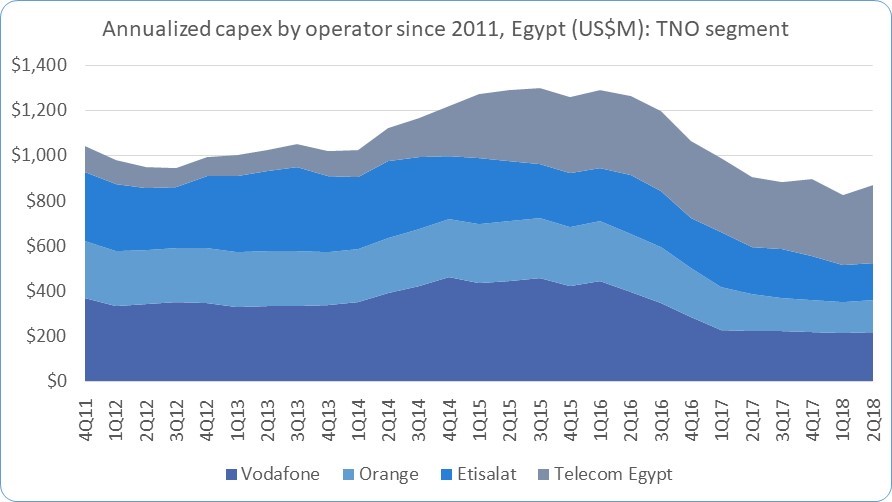

Egypt’s government has liberalized its control of the sector cautiously over the years. The government retains an 80% stake in Telecom Egypt, 13 years after its IPO. TE remains the largest of Egypt’s four operator groups, followed by local units of Vodafone (UK), Orange (France), and Etisalat (UAE). All have 4G licenses now, but TE dominates fixed markets. The four accounted for a $870M in capex for the 3Q17-2Q18 period, a figure likely to rise significantly over the next 2-3 years due to the scaling of LTE and FTTC-based DSL.

Egypt boasts a number of opportunities for vendors of network infrastructure and related software and services:

- 4G network spending is ongoing, will shift more to software & services over time

- Fixed broadband penetration is very low in Egypt, leaving lots of untapped demand for Orange, Vodafone & Etisalat to build into

- Content-related investments are needed to support growing video and similar multimedia usage on 4G and fixed broadband networks

- Egypt lacks data center/cloud infrastructure relative to peer markets, and the government is trying to rectify this

China has raised its profile in Egypt considerably in recent years, partly through projects under the One Belt One Road program. The biggest of these is Egypt’s new capital, 45km east of Cairo. Chinese banks have committed several billion in financing. The terms generally require the use of Chinese technology. This has implications for the vendor mix in network infrastructure, as well. Huawei has already won contracts in the new capital, and ZTE is back in business in Egypt. Success in the new capital could help these vendors’ elsewhere in Egypt, at a minimum with incumbent Telecom Egypt.

Format: PDF (available in PPT upon request)

- Table Of Contents

- Figure & Charts

- Coverage

- Visuals

Table Of Contents

Executive summary

Macroeconomic and political context

Egypt 2030 vision

Telecom regulatory climate

Telecom market (mobile and fixed services; transmission infrastructure)

Network operators (TE, Vodafone Egypt, Orange Egypt, and Etisalat Egypt)

Concluding comments

Appendix

Figure & Charts

- Macro indicators: Population (M)

- Macro indicators: USD to EGP

- Macro indicators: Real GDP growth

- Macro indicators: Core inflation

- Subscribers by operator: 2013-17

- Fixed and mobile subscribers: total, and broadband subs per 100

- Network operator capex: annualized total by operator since 2011, and, share by operator for the last five annualized periods.

- Voice and data household penetration

- Voice and data mobile penetration

- ADSL subscribers (000s)

- Voice and data household penetration

- Telecom Egypt: Revenues ($M) and capital intensity, annualized

- Telecom Egypt’s 2016-18 capex by category

- Vodafone Egypt: Revenues ($M) and capital intensity, annualized

- Orange Egypt: Revenues ($M) and capital intensity, annualized

- Etisalat Egypt: Revenues ($M) and capital intensity, annualized

Coverage

Visuals