By Matt Walker

Nokia held an online forum for industry analysts last week. Over four days of presentations, the company presented a compelling case for why it will remain a top tier supplier to telcos as they evolve networks and business models over the next 5-10 years. The company also highlighted strong positioning for new opportunities related to webscale/cloud and private (enterprise) networks. In the telco network infrastructure (telco NI) market, Nokia is #3 behind Huawei and Ericsson, but #2 (behind only Huawei) if you exclude services. It has a comprehensive offering across mobile, fixed broadband, optical, IP, subsea, and software, and has strong R&D chops. In the webscale/cloud world, Nokia is a relative newcomer but was among the earliest big telco-focused vendors to launch deep collaborations with the three main cloud players. Further, it has reorganized the company to go after “cloud and network services” opportunities. The company is credible when it talks about the importance of sustainability, which deserves far more attention than it gets, and which Nokia’s customers will care more about every year as energy bills rise and climate change worsens. While Nokia has plenty of competition in both its core telco and cloud/enterprise markets, the weakening of Huawei in the last 3 years is another boost for the company. The future looks good for Nokia.

- Table Of Contents

- Figures

- Coverage

- Visuals

Table Of Contents

Summary – page 2

Nokia’s current market position – page 2

Analyst event takeaways – page 3

Conclusion – page 5

About – page 6

Figures

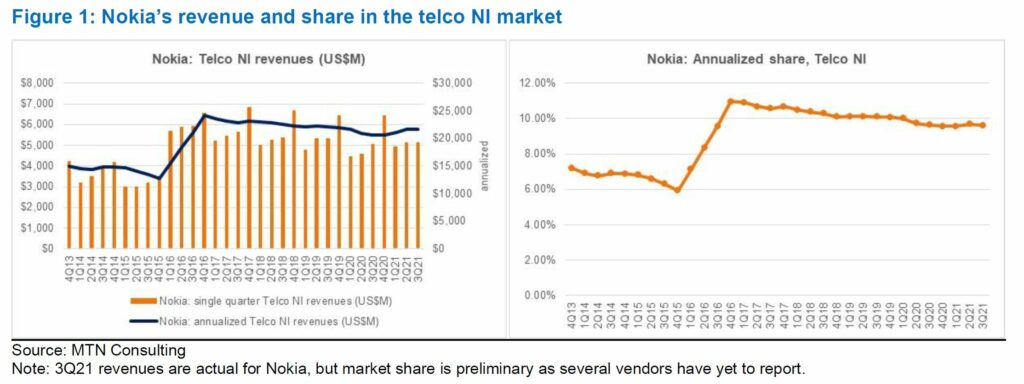

Figure 1: Nokia’s revenue and share in the telco NI market

Figure 2: Photonic Service Engine 5 family – different application scenarios

Coverage

Companies and organizations mentioned in this report include:

Adtran

Alcatel-Lucent

AWS

Azure

Calix

Cellnex

Cisco

CommScope

DZS

Ericsson

Fiberhome

GCP

Harmonic

Huawei

Meta (Facebook)

Nokia

Orange

Vodafone

ZTE

Visuals