By Matt Walker

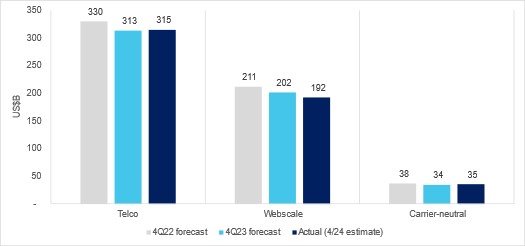

This note summarizes 2023 capex results for each of three segments of network operators tracked by MTN Consulting: telco, webscale, and carrier-neutral. The note also discusses capex-related news from early 2024, and presents an informal update to our December 2023 spending forecast. That forecast projects capex in 2024, by segment, to amount to: $309 billion (B) for telco (2023 actual: $315B), $203B for webscale (2023: $192B), and $39B for carrier-neutral (2023: $35B). That would total to $552B, just 1.6% growth above the 2023 actual. While we continue to expect telco spending to be tightly controlled in 2024, the generative AI (GenAI) hype will push webscale & carrier-neutral capex higher than expected by at least another $10-20 billion. Telco capex in 2024, though, is likely to come in about $10-20B less than anticipated last year, roughly offsetting the webscale/CNNO outperformance. We will provide a formal update to our spending forecast within the next 3 months.

- Table Of Contents

- Figures and Tables

- Coverage

- Visuals

Table Of Contents

- Summary: page 1

- 2023 capex came in ~$30B less than we expected in 2022: page 1

- Telco spending has weak second half in 2023, off to slow start in 2024 – page 2

- Webscale capex was $192B in 2023, a bit light, but is booming in YTD2024 – page 3

- Carrier-neutral capex was $35B in 2023, with upside driven by hyperscale – page 4

- Generative AI and telecom – page 4

- Appendix – page 5

Figures and Tables

Figure 1: Capex by operator segment in 2023, actual versus projected

Coverage

Companies mentioned:

Alphabet

Altice USA

Amazon

AMD

American Tower

Apple

AT&T

Bayer

BCE

Charter Communications

Ciena

Cintas

Cisco

Comcast

DigitalBridge

Equinix

Ericsson

Huawei

Intel

Liberty Global

Mercedes Benz

Meta

Microsoft

Nokia

NVIDIA

Oracle

Swisscom

Telefonica

Telenor

TSMC

Verizon

Walmart

Visuals