By Matt Walker

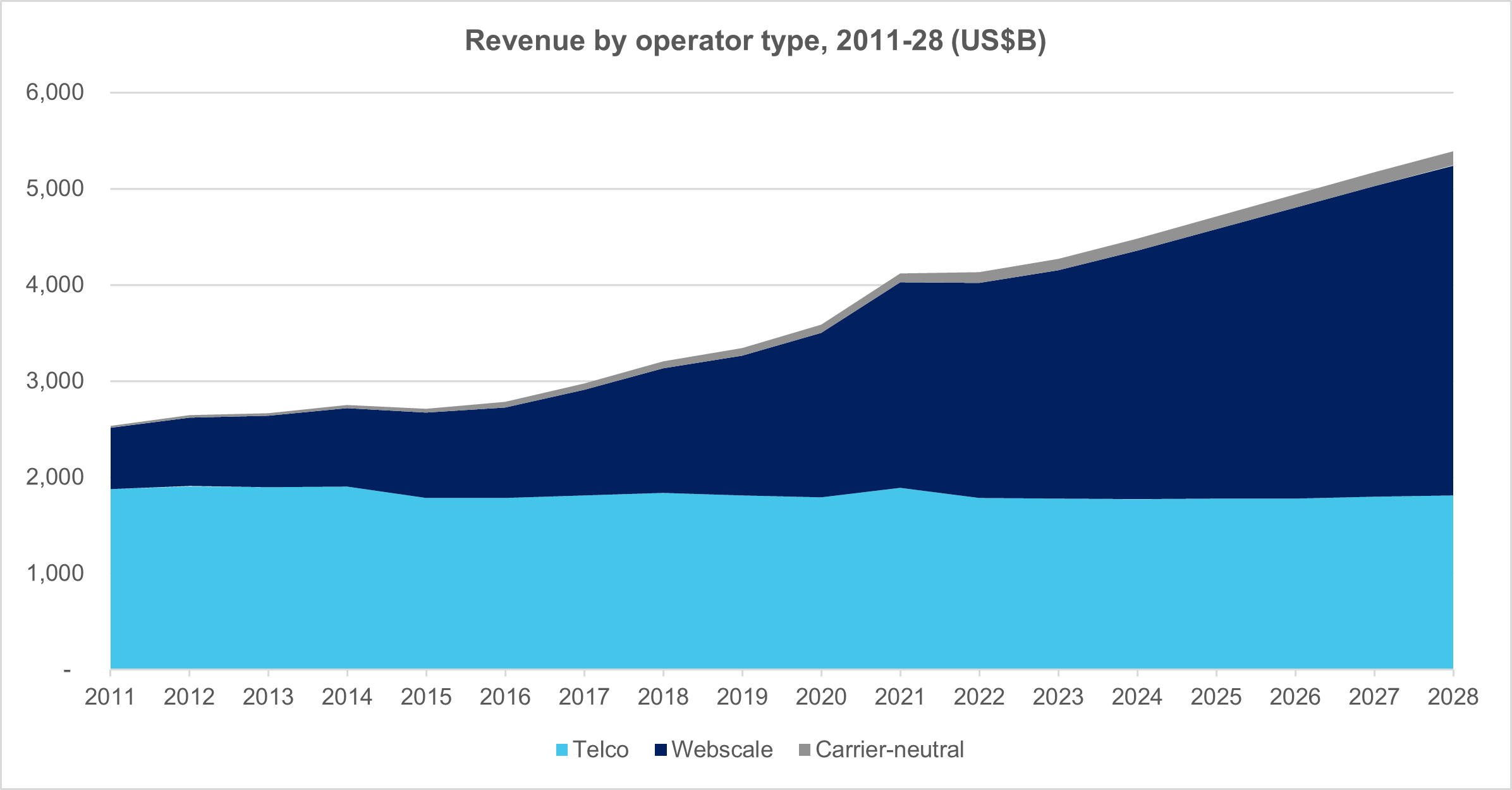

This forecast presents our latest projections for the network operator market, spanning telecommunications operators (telcos), webscalers, and carrier-neutral network operators (CNNOs). The forecast is based on our quarterly coverage of over 175 operators, and reflects market realities through the end of 3Q24. Our forecast includes revenues, capex and employee totals for all segments, and additional metrics for each individual segment. In 2024, we expect the three operator groups to account for $4.48 trillion (T) in revenues (2023: $4.27T), $612 billion (B) in capex (2023: $548B), and 8.86 million (M) employees (2023: 8.81M). This report provides 2011-23 actuals and projections through 2028, and includes projections from the most recent full forecast (12/23) for reference.

Below are the key highlights of the report:

Vendor addressable market: Tech vendors sell various products and services to each of the three operator segments tracked in this forecast – everything from GPU server chips to fiber optic splice enclosures to radio antennas to network construction to cloud software. Their addressable market is directly related to capex, which captures most external technology purchases including a large portion of software & services expenses. In 2011, the starting point of our coverage, total three segment capex was $336 billion, 90% of which was telco. By 2028, three segment capex will reach $638 billion, and telco will account for only 44% of the total. In the intervening years, an important segment of third-party neutral operators of network capacity and space has evolved; CNNO capex was just $6B in 2011 but will hit about $54B by 2028. But the real story of the market is webscale: capex spend by webscalers has surged multiple times as these tech companies innovate, scale and capture more of the world’s digital value. In 2011, webscale capex was $29B, or 8% of the comms operator market. In 2023, it reached $193B (35% of total), and AI/GenAI demand is currently fueling it through another up cycle, which will push webscale to about $303B by 2028, or 48% of total (and more than telco for the first time).

Telco

This report includes region- and country-level projections for the telecommunications network operator (TNO, or telco) market. These projections are based upon MTN Consulting’s quarterly coverage of 140 telcos across the globe, spanning 1Q11 through 2Q24. For 2024, we expect global telco revenues of $1,772 billion (flat versus 2023), capex of $297B (down 5% YoY), and employees of 4.457 million (down 1.2% YoY). Labor costs per employee in 2024 will be about $60.8K, up from $58.7K in 2023.

Webscale

This report includes projections for the growth and development of the webscale network operator (WNO, or webscale) market. The projections are based on our quarterly coverage of 21 webscalers, spanning 1Q11-2Q24, and they break out China from the rest of the globe. For 2024, we expect global webscale revenues of $2,584 billion, up 9% YoY, $311B in R&D spending (+6% YoY), $267 billion in capex (+39% YoY), and 4.284 million employees (+2.4% YoY). Our forecast for webscale capex has significantly increased since the last update in late 2023. However, the unusual spike in capex underway in 2024 will be followed by two years of decline.

Carrier-neutral

This report also includes projections for the growth and development of the carrier-neutral network operator (CNNO) market. The CNNO market is the smallest of three operator segments tracked by MTN Consulting, but CNNOs play a crucial, complementary role in the communications sector and own and operate a large portion of the world’s cell towers, data centers, and fiber networks. Our CNNO projections are based upon quarterly tracking of 47 CNNOs across the globe. Our CNNO tracking is focused on publicly traded companies but we also attempt to capture the significant private equity-led activity in this sector. In 2024, we expect CNNO revenues to total about $125B (+4% YoY), capex of $48B (+16% YoY), and about 120K employees (flat YoY). CNNOs’ asset base includes over 1,500 data centers, 3.3 million cell towers, and 1.1 million fiber route miles.

- Table Of Contents

- Figures & Charts

- Coverage

- Visuals

Table Of Contents

Key sections include:

- Report Highlights

- Summary

- Network Operator Totals

- Telco

- Telco – Regional Splits

- Webscale

- Carrier-neutral (CNNO)

- Spending outlook for top operators

- About

Figures & Charts

This report has a large number of figures on each of the main result tabs: totals, telco, telco – regional splits, webscale, and carrier-neutral (CNNO). For a full list of figures please contact us. Here is a list of figures on the “Totals” tab:

Capex forecast by segment: 4Q24 v. Dec 2023 forecasts, % difference

Capex forecast by segment: 4Q24 v. Dec 2023 forecasts, $B difference

Revenue growth rates, all operators: New vs. old forecast

Revenue growth rates, Telcos: New vs. old forecast

Capital intensity, Telcos: New vs. old forecast

Capital intensity, Webscalers: New vs. old forecast

Capital intensity, Carrier-neutral operators: New vs. old forecast

Revenue by operator type, 2011-28 (US$B)

Capex by operator type, 2011-28 (US$B)

Capex by operator type, 2011-28: % of total

Capital intensity by operator type, 2011-28

Employees by operator type (M)

Revenues/employee by operator type (US$K)

Network operator revenues by type, % global GDP

Network operator employees (M), and % global population

Telco revenues and capex per sub, 2011-22

Top 50 spending operators, annualized 2Q24 capex ($B)

Top 50 operators based on long-term capital intensity (3Q19-2Q24 avg)

Coverage

Companies mentioned:

21Vianet

A1 Telekom Austria

Advanced Info Service (AIS)

Airtel

Alibaba

Alphabet

Altice Europe

Altice USA

Amazon

America Movil

American Tower

Apple

AT&T

Axiata

Axtel

Baidu

Balitower

Batelco

BCE

Bezeq Israel

Bharti Infratel

Bouygues Telecom

BSNL

BT

Cable ONE, Inc.

Cell C

Cellcom Israel

Cellnex

CenturyLink

Charter Communications

China Broadcasting Network

China Mobile

China Telecom

China Tower

China Unicom

ChinData

Chorus Limited

Chunghwa Telecom

Cincinatti Bell

CK Hutchison

Cogeco

Cogent

Cognizant

Comcast

Consolidated Communications

Crown Castle

Cyfrowy Polsat

CyrusOne

Cyxtera

DEN Networks Limited

Deutsche Telekom

Digi Communications

Digital Realty

DigitalBridge

Dish Network

Dish TV India Limited

Du

eBay

EI Towers

Elisa

Entel

Equinix

Etisalat

Far EasTone Telecommunications Co., Ltd.

Frontier Communications

Fujitsu

GDS Data Centers

Globe Telecom

Grupo Clarin

Grupo Televisa

GTL Infrastructure

Hathway Cable & Datacom Limited

Helios Towers

HPE

IBM

IBS Towers

IHS Towers

Iliad SA

Internap

Inwit

JD.COM

KDDI

Keppel DC REIT

KPN

KT

Level 3

LG Uplus

Liberty Global

M1

Maroc Telecom

Masmovil

Maxis Berhad

Megafon

Meta (FB)

Microsoft

Millicom

Mobile Telesystems

MTN Group

MTNL

NBN Australia

NEXTDC

NTT

Oi

Omantel

Ooredoo

Oracle

Orange

PCCW

PLDT

Proximus

QTS Realty

Quebecor Telecommunications

Rakuten

Reliance Communications Limited

Reliance Jio

Rogers

Rostelecom

Safaricom Limited

SAP

Sasktel

SBA Communications

Shaw

Singtel

SITI Networks Limited

SK Telecom

SmarTone

SMN (Protelindo)

SoftBank

Spark New Zealand Limited

StarHub

STC (Saudi Telecom)

Summit Digitel

Sunevision

Superloop

Swisscom

Switch

Taiwan Mobile

Tata Communications

Tata Teleservices

TDC

TDF Infrastructure/Arcus

TDS

Tele2 AB

Telecom Argentina

Telecom Egypt

Telecom Italia

Telefonica

Telekom Malaysia Berhad

Telenor

Telesites

Telia

Telkom Indonesia

Telkom SA

Telstra

Telus

Tencent

Thaicom

Tower Bersama

TPG Telecom Limited

True Corp

Turk Telekom

Turkcell

Twitter

Uniti Group

Veon

Verizon

Vodafone

Vodafone Idea Limited

VodafoneZiggo

Windstream

Yandex

Zain

Zain KSA

Zayo

Visuals