By Arun Menon

This brief report explores three potential new growth markets for satellite operators who are looking to overcome intense competition, tough macro conditions, and the niche nature of their market. The report also discusses the impact on the traditional telecom market, revenue opportunity for telcos from satellite partnerships, and key challenges confronting satellite operators.

Satellite operators are being forced to expand their addressable markets in the near term, courtesy several factors: rising competition, with the emergence of players such as SpaceX along with several upstarts including AST SpaceMobile and Lynk; a tough funding climate resulting from a grim economic outlook and rising interest rates; and, market concentration risks arising from the current focus on satellite broadband internet. To address the situation, operators are raising stakes in new pursuits and developing new offerings. MTN Consulting expects three new potential addressable markets to provide transformational opportunities for satellite operators in the next 2-4 years. These include Direct-to-device (D2D), Internet of Things (IoT), and cloud-based services. Looking at these market opportunities, a thought may arise whether satellite operators are trying to disrupt the traditional telecom market. But the reality is that telcos will continue to be the primary service provider for wireless access. Telcos are also going to benefit from partnerships with satellite operators as they will aid in providing an enhanced experience for telco customers, reinforced by ubiquitous coverage. For satellite operators though, navigating the regulatory hurdles and ensuring constant capital flow are key concerns; several players from the current herd will vanish in the next 3-5 years.

- Table Of Contents

- Figures and Tables

- Coverage

- Visuals

Table Of Contents

- Summary – page 2

- Satellite operators eye diversification to deter rising competition, macro uncertainty, and niche focus concerns – page 2

- Transformational opportunities emerge in Direct-to-device (D2D), IoT, and cloud-based services – page 4

- Should telcos worry? – page 7

- Navigating regulatory hurdles and ensuring constant capital flow will prove tricky for satellite operators – page 9

- Appendix – page 11

Figures and Tables

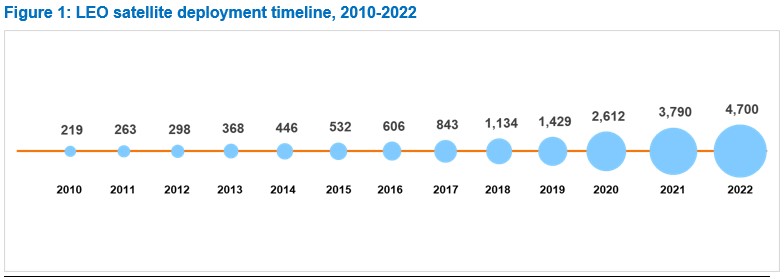

Figure 1: LEO satellite deployment timeline, 2010-2022

Figure 2: Illustration of OQ Technology’s operating model

Figure 3: D2D revenue opportunity for telcos (US$B)

Figure 4: Private investments in the space economy, 2015-22 (US$B)

Coverage

Companies mentioned:

Amazon

Amazon Web Services (AWS)

Apple

Arianespace

AST SpaceMobile

AT&T

Axiom Space

BICS

Blue Origin

Deutsche Telekom

Echostar

Eutelsat

Geely

GI Partners

Globalstar

Google

Google Cloud Platform

Hughes Network Systems

Inmarsat

Intelsat

Iridium

Jio Satellite Communications

Juniper Networks

LEOcloud

Ligado Networks

Lynk

Microsoft

Microsoft Azure

NBN Co

Omnispace

OneWeb

OQ Technology

Orbcomm

OrbitsEdge

Qualcomm

Rakuten

Reliance Jio

Rivada Space Networks

Sateliot

Sensefinity

SES

Skylo

SpaceX

Swarm Technologies

Telefonica

Tesla

T-Mobile

United Launch Alliance

Verizon

ViaSat

Vodafone

Visuals