By Arun Menon

This brief analyzes demand for network infrastructure solutions (hardware, software, and services) in the telecommunications (telco) industry as of mid-2024. The brief addresses prospects for spending growth, vendor market share dynamics, and what strategies vendors should pursue to cope with the current market environment.

The telecom vendor market is navigating a turbulent landscape shaped by significant shifts and challenges. In 2023, telco network infrastructure (telco NI) vendor revenues declined sharply, down 9.2% annually to $211.8 billion, marking the steepest drop at least since 2014. This downturn reflects the completion of 5G buildouts in major markets like the US, China, and parts of Europe, following a period of intense investment. As telcos scale back spending amid economic slowdowns and high interest rates, operators face capital constraints, intensifying vendor market pressures.

Adding to the complexity are geopolitical tensions disrupting supply chains and market access, notably impacting vendors like Huawei and ZTE, due to security concerns. These challenges have prompted telcos to reevaluate vendor partnerships to ensure alignment with national security priorities, further reshaping market dynamics. Meanwhile, the rise of webscale cloud providers – AWS, GCP, and Azure – is transforming telecom infrastructure through cloud migration, AI integration, and advanced automation, posing both competitive threats and partnership opportunities for traditional vendors.

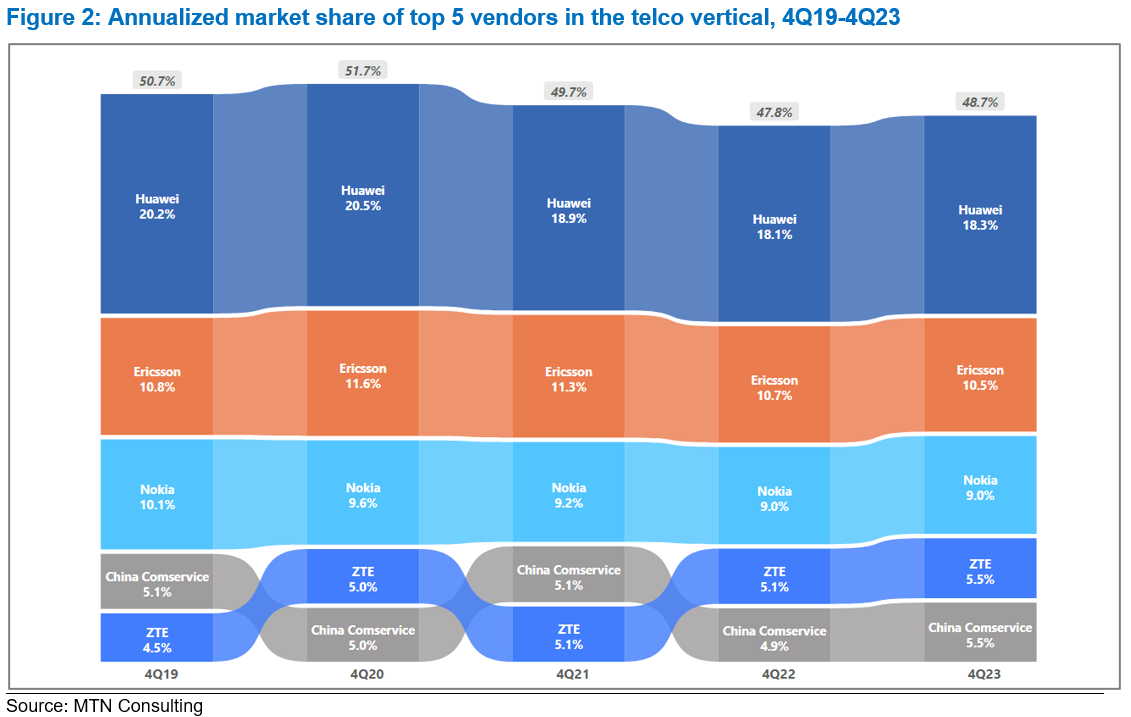

The top three telco NI vendors remain the same as for the last few years: Huawei, Ericsson, and Nokia, with aggregate share totaling just under 38%, unchanged from 2022. Despite this apparent stability, significant market shifts are unfolding. These shifts, sparked by a downturn in telco spending, include vendor consolidation illustrated by Broadcom’s acquisition of VMware, HPE-Juniper, and Nokia-Infinera; alongside operational restructuring and widespread layoffs across the industry. Additionally, cloud providers are reshaping the vendor landscape by offering cloud-based telecom solutions, albeit with modest market share gains. Another notable shift is the push for Open RAN adoption by established vendors and telcos who are increasingly embracing open architectures supported by substantial government investments. Developments such as AT&T’s partnership with Ericsson and Deutsche Telekom’s collaboration with Nokia reflect growing momentum towards open, interoperable networks, albeit with integration challenges and slower-than-expected uptake among brownfield operators.

Looking ahead, the vendor market faces a mixed outlook for 2024, with projected telco capex declines and ongoing economic pressures likely to dampen revenue prospects in the first half. Regional developments in North America and Europe offer pockets of growth potential, driven by broadband expansion and regulatory shifts favoring non-Chinese vendors. But these may not fully offset the first-half setbacks. Substantial gains are projected from 2025 onward, indicating that while 2024 is likely to decline, it won’t be as severe as 9.2% YoY drop in 2023.

- Table Of Contents

- Figures and Tables

- Coverage

- Visuals

Table Of Contents

- Summary – page 2

- Vendor market roils as 5G buildouts end in key markets amid macroeconomic uncertainty – page 2

- Market dynamics shift amid cloud providers’ rise, market consolidation, vendor overhaul, and Open RAN push – page 4

- Mixed outlook for vendor market as challenging 1H24 may potentially improve in 2H24 – page 10

- Appendix – page 14

Figures and Tables

Figures:

Figure 1: Annualized Telco NI vendor revenues ($B) vs. YoY annualized sales growth (%)

Figure 2: Annualized market share of top 5 vendors in the telco vertical, 4Q19-4Q23

Figure 3: Annualized vendor revenues ($B) in telco vertical, 4Q19-4Q23

Tables:

Table 1: Outlook commentary for select key vendors

Coverage

Companies mentioned:

Adtran

Aeris Communications

Airspan

Alcatel Submarine Networks

Alphabet

Amazon

Amazon Web Services (AWS)

Amdocs

AT&T

BCE

Bharti Airtel

Broadcom

Calix

Casa Systems

China Comservice

Ciena

Cisco

CommScope

Dell Technologies

Deutsche Telekom

Dish Network

E& UAE

Ericsson

Fujitsu

Google Cloud Platform (GCP)

HPE

Huawei

Infinera

Juniper Networks

Lumine Group

Mavenir

Microsoft

Microsoft Azure

NEC

Nokia

O2 Telefonica

Orange

Parallel Wireless

Rakuten

Red Hat

Reliance Jio

Samsung

Splunk

Vantiva

Vecima Networks

Verizon

VMware

Vodafone

ZTE

Visuals