By Arun Menon

This market review provides a comprehensive assessment of the global telecommunications industry based on financial results through September 2022 (3Q22). The report tracks revenue, capex and employees for 139 individual telecommunications network operators (TNOs). For a sub-group of 79 large TNOs, the report also assesses labor cost, opex and operating profit trends. The report also covers annual data for other financial metrics such as debt, cash & short term investments, M&A spend and cash flow from operations for all the 79 companies from the TNO-79 subset. Our coverage timeframe spans 1Q11-3Q22 (47 quarters). The report’s format is Excel.

ABSTRACT

3Q22 RESULTS SUMMARY

Telco quarterly topline registers second biggest decline since 3Q15

Telco industry revenues dropped by 6.6% on a YoY basis to post $435.0 billion (B) in the latest single quarter ending 3Q22. The quarterly dip was the fourth consecutive slump and surpassed 2Q22’s 6.2% decline to post the steepest falloff since 3Q15. The decline also impacted revenues and its growth rate for the annualized 3Q22 period – they were $1,821.6B, down 4.0% YoY over the same period in the previous year.

AT&T’s April 2022 spinoff of its WarnerMedia unit was one factor which impacted growth rates. As reported by the company, AT&T’s 3Q22 revenues (post spinoff) fell by 24.7% YoY. Without the AT&T spinoff, the industry’s revenue growth would have been slightly better. However, inflationary pressures, slow economic growth and energy prices in particular also impacted many telcos. That includes Vodafone, whose revenues fell 12.5% YoY in 3Q22; the company lowered its earnings outlook and is pursuing cost-saving measures to weather the rising economic woes.

Among the top 20 companies by revenues, the three Chinese operators with the strongest growth on an annualized basis. These include China Telecom (8.9% YoY vs. annualized 3Q21), China Mobile (8.9%), China Unicom (7.0%). Growth witnessed by the three Chinese telecom giants was largely due to a surge in their “emerging businesses” revenues. These businesses include cloud computing, big data, internet data centers, and Internet of Things (IoT). Notably, none among the top 20 operators by annualized revenues were able to post double-digit growth rates. Growth witnessed by a few other operators was mostly an outcome of non-service revenues, as these have grown with 5G device sales in many markets. Telcos now hope that the 5G-enabled devices already deployed will help to generate new revenue streams in 2023 and beyond. MTN Consulting’s latest forecast calls for 2022 telco revenues of $1,835B, down 3% YoY. The worst annualized telco growth among the top 20 operators came from AT&T, down 20.1% on an annualized basis, largely due to the WarnerMedia spinoff. However, 11 other out of the top 20 operators posted a decline in revenues on an annualized basis in 3Q22, without a big asset sale to explain the drop. Four other top 20 operators, namely America Movil (-15.5%), Telefonica (-11.7%), KDDI (-10.5%), and NTT (-10.1%) saw revenues decline by >10% on an annualized basis in 3Q22.

Capital intensity at an all-time high

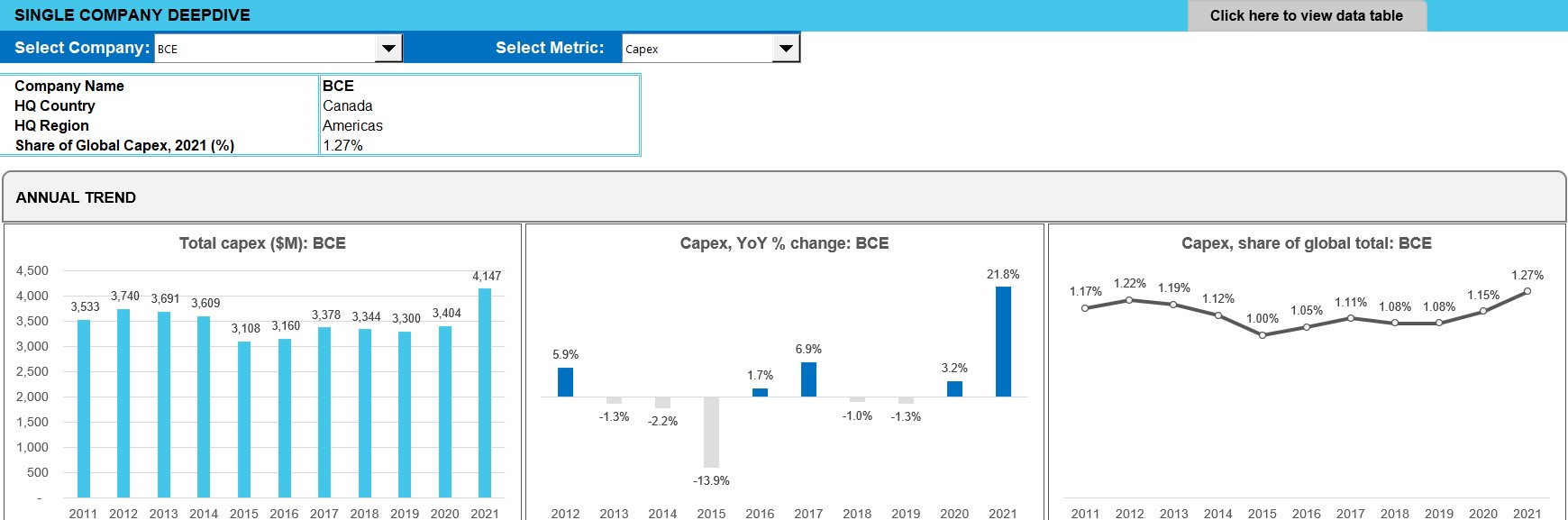

Stalled revenue growth and macro pressures somewhat impacted the capex spend of telcos in the latest quarter. Telco investments declined, for the first time since 4Q20, by 5% on a YoY basis to post $77B in 3Q22. The decline in the latest quarter also knocked down annualized capex to $325.7B in 3Q22, from the peak of $329.5B in the prior annualized quarter. Due to multiple quarters of strong capex spend, annualized capital intensity reached a new all-time high of 17.9% in 3Q22. A few countries are just starting to deploy 5G, notably India; many more continue to scale up 5G to reach mass market coverage, and deploy fiber to support fixed broadband and to connect all the new radio infra (including small cells) needed for 5G. There is also a growing number of stand-alone 5G core networks, which is helping the cloud providers improve their penetration into the telco sector. MTN Consulting expects full-year 2022 capex to total $330B.

As noted earlier, the market’s annualized capital intensity rose to a record high, from 16.8% in 3Q21 to 17.9% in 3Q22. The previous high of 17.8% was recorded in the previous quarter (2Q22); another notable peak came in 1Q16 (17.5%), amidst the LTE boom. At the operator level, Rakuten beat all other telcos handily with a roughly 145.1% capex/revenue ratio on an annualized basis; this has been declining in the recent quarters as its greenfield network rollout is reaching its peak. Globe Telecom’s capital intensity for the annualized 3Q22 period stood at 59.1%, the highest among established operators. Globe’s figure is due to a network infrastructure buildup that includes 1,080 new cell sites, upgrades to at least 12,900 sites including both 4G LTE and 5G, and installation of over one million fiber-to-the-home lines. PLDT’s annualized capital intensity stood at 52.9% in 3Q22, as spending ramped both for meeting connectivity demands and taking on new competition from the new mobile player Dito Telecommunity Corp.

The biggest capex spender in 3Q22 on an annualized basis was China Mobile ($28.2B), but its annualized growth slowed down to 2.6% in the latest quarter due to the telco’s efforts to share costs on the network side enabled by a partnership with China Broadcasting Network. China Mobile’s single-quarter capex declined by 13.3%. Five out of the top 20 operators by annualized capex spend posted double-digit growth rates in the period ended 3Q22. Some of these include: America Movil (48.1% YoY vs. annualized 3Q21), BT (32.2%), Verizon (24.3%), AT&T (16.8%), and Charter Communications (11.9%).

Telcos continue to embrace digital transformation and automation to drive profitability

Telcos have historically maintained stable profitability margins – EBIT margins have been in the range of 13-18% while EBITDA margins have never gone down below 30% since 2011. This continues to stretch out into 2022 despite the immense burden of investments, stagnating revenues, and macro pressures in the past several quarters. Annualized EBITDA margin for the industry was 33.7% in 3Q22, while annualized EBIT (operating) margin ended 3Q22 at 14.5%. Within the overall telco opex budget, telcos are having success in cutting their sales & marketing and G&A spending, as telcos adjust to working from home and accelerate the migration of sales & support to digital platforms. These efforts accelerated in 2020, as COVID-19 spread and telcos were forced to do business with minimal human intervention, but have continued in 2021-22. MTN Consulting expects telcos to continue reducing their headcount by revamping their processes, investing in digital transformation, and adopting automation. Labor’s share of opex ex-D&A will remain relatively steady, though, as the average employee becomes costlier. Meanwhile, many telcos are reporting that network operations is taking up a larger portion of the opex pie. To drive sweeping changes going forward, telcos will have to implement dramatic, strategic measures to optimize their cost structure in order to increase and sustain profitability. These strategic measures will be a mix of technology-enabled solutions and collaborations, some of which will transform the telco business model. While automation will continue to be a key enabler, other strategic cost optimization measures that telcos will pursue over the next 2-3 years include core network sharing, network slicing, and partnerships with webscale cloud providers, each of which has the potential to hit multiple cost bases.

Industry headcount continues to be on a downward spiral

Telco industry headcount was 4.59 million in 3Q22, down from 4.70 million a year ago. MTN Consulting expects headcount reductions to continue via attrition and voluntary retirement schemes, heading towards 4.122 million by 2027. Spending on employees (labor costs) continues to be on a rise though on a per-person basis. Even as telcos cut headcount, they recognize how key their workforce is to success. As such they are investing in training programs, and hiring a new generation of highly-skilled employees able to function in the telco of 2022. Data from 3Q22 suggests that telcos’ average labor costs per employee are moderating – annualized labor costs per employee reached $56.4K in 3Q22, the same level as in 3Q21. However, MTN Consulting expects the average telco employee salary to continue rising, reaching just above US$69.2K by 2027.

Americas makes a strong comeback, now biggest region based on both revenues and capex

The Americas region rebounded to become the single largest region by revenues in 3Q22, surpassing Asia, the leader of the previous two quarters. In terms of growth, all regions registered revenue declines in 3Q22 with Europe declining the most by 10.8%. On a capex basis, the Americas region outspent the Asia region for the first time since 2Q13; America Movil, Verizon and AT&T are responsible for most of this growth. The Americas region was also the only one to register growth in capex, as other regions experienced a spending slump. Asia registered a steep YoY decline in capex spend of 18.9% in 3Q22 thanks to the reduced spending by the three Chinese telcos – China Mobile, China Telecom, and China Unicom – as 5G capex peak wanes off coupled with greater focus on network sharing. Europe continued its lead with the highest regional capital intensity on an annualized basis, posting 19.7% in 3Q22. This surge was a direct result of 5G buildouts, many of which were delayed from 2020 due to COVID shutdowns and spectrum auction delays.

- Table Of Contents

- Figure & Charts

- Coverage

- Visuals

Table Of Contents

- Abstract

- Market snapshot

- Analysis

- Key stats through 3Q22

- Labor stats

- Operator rankings

- Company Deepdive & Benchmarking

- Country breakouts

- Country breakouts by company

- Regional breakouts

- Raw Data

- Subs & traffic

- Exchange rates

- Methodology & Scope

- About

Figure & Charts

- TNO market size & growth by: Revenues, Capex, Employees – 1Q20-3Q22

- Regional trends by: Revenues, Capex – 1Q20-3Q22

- Opex & Cost trends

- Labor cost trends: 1Q20-3Q22

- Profitability margin trends: 1Q20-3Q22

- Spending (opex, labor costs, capex): annual and quarterly trend

- Key ratios: annual and quarterly trend

- Workforce & productivity trends: 1Q14-3Q22

- Operator rankings by revenue and capex: latest single-quarter and annualized periods

- Top 20 TNOs by capital intensity: latest single-quarter and annualized periods

- Top 20 TNOs by employee base: latest single-quarter

- TNOs: YoY growth in single quarter revenues

- TNOs: Annualized capital intensity, 1Q16-3Q22

- TNOs: Revenue and RPE, annualized 1Q16-3Q22

- TNOs: Capex and capital intensity (annualized), 1Q16-3Q22

- TNOs: Total headcount trends, 1Q16-3Q22

- TNOs: Revenue and RPE trends, 2011-21

- TNOs: Capex and capital intensity, 2011-21 ($ Mn)

- TNOs: Capex and capital intensity, 1Q16-3Q22 ($ Mn)

- TNOs: Revenue and RPE trends, 1Q16-3Q22

- Top 79 TNOs by total opex, 3Q22

- Top 79 TNOs by labor costs, 3Q22

- TNOs: Software as % of total capex

- TNOs: Software & spectrum spend

- TNOs: Total M&A, spectrum and capex (excl. spectrum)

- Top 79 TNOs by total debt: 2011-21

- Top 79 TNOs by total net debt: 2011-21

- Top 79 TNOs by long term debt: 2011-21

- Top 79 TNOs by short term debt: 2011-21

- Top 79 TNOs by total cash and short term investments ($M): 2011-21

Coverage

Operator coverage:

| A1 Telekom Austria | Advanced Info Service (AIS) | Airtel | Altice Europe | Altice USA | America Movil | AT&T | Axiata | Axtel | Batelco |

| BCE | Bezeq Israel | Bouygues Telecom | BSNL | BT | Cable ONE, Inc. | Cablevision | Cell C | Cellcom Israel | CenturyLink |

| Cequel Communications | Charter Communications | China Broadcasting Network | China Mobile | China Telecom | China Unicom | Chunghwa Telecom | Cincinatti Bell | CK Hutchison | Clearwire |

| Cogeco | Com Hem Holding AB | Comcast | Consolidated Communications | Cyfrowy Polsat | DEN Networks Limited | Deutsche Telekom | Digi Communications | DirecTV | Dish Network |

| Dish TV India Limited | DNA Ltd. | Du | EE | Elisa | Entel | Etisalat | Fairpoint Communications | Far EasTone Telecommunications Co., Ltd. | Frontier Communications |

| Globe Telecom | Grupo Clarin | Grupo Televisa | Hathway Cable & Datacom Limited | Idea Cellular Limited | Iliad SA | KDDI | KPN | KT | Leap Wireless |

| LG Uplus | Liberty Global | M1 | Manitoba Telecom Services | Maroc Telecom | Maxis Berhad | Megafon | MetroPCS Communications | Millicom | Mobile Telesystems |

| MTN Group | MTNL | NTT | Oi | Omantel | Ono | Ooredoo | Orange | PCCW | PLDT |

| Proximus | Quebecor Telecommunications | Rakuten | Reliance Communications Limited | Reliance Jio | Rogers | Rostelecom | Safaricom Limited | Sasktel | Shaw |

| Singtel | SITI Networks Limited | SK Telecom | Sky plc | SmarTone | SoftBank | Spark New Zealand Limited | Sprint | StarHub | STC (Saudi Telecom) |

| SureWest Communications | Swisscom | Taiwan Mobile | Tata Communications | Tata Teleservices | TDC | TDS | Tele2 AB | Telecom Argentina | Telecom Egypt |

| Telecom Italia | Telefonica | Telekom Malaysia Berhad | Telenor | Telia | Telkom Indonesia | Telkom SA | Telstra | Telus | Thaicom |

| Time Warner | Time Warner Cable | TPG Telecom Limited | True Corp | Turk Telekom | Turkcell | Veon | Verizon | Virgin Media | Vivendi |

| Vodafone | Vodafone Idea Limited | VodafoneZiggo | Wind Tre | Windstream | Zain | Zain KSA | Ziggo | ||

| Masmovil |

Regional coverage:

| Asia | Americas | Europe | MEA |

Visuals