By Arun Menon

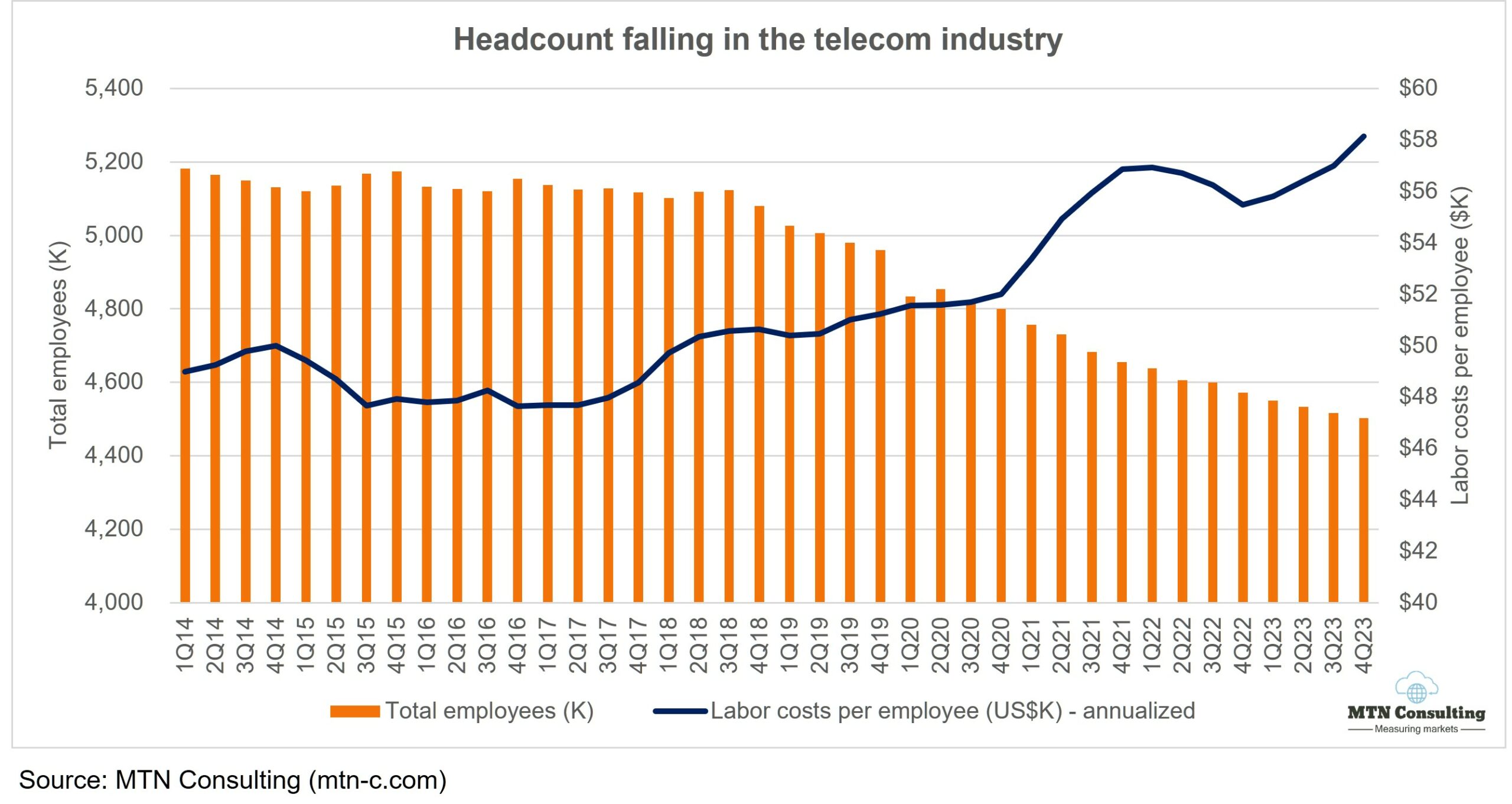

This report reviews the growth and development of the telecommunications network operator (TNO, or telco) market. The report tracks a wide range of financial stats for 139 telcos across the globe, from 1Q11 through 4Q23. For the full-year 2023, telcos represented $1.77 trillion (T) in revenues (-0.7% YoY), $263.1 billion (B) in labor costs (3.0% YoY), and $315.1B in capex (-3.6% YoY). They employed approximately 4.50 million people as of December 2023, down 1.5% from the prior year.

Below are the key highlights of the report:

Revenues: Telco topline posted a modest growth of 1.7% on a YoY basis to post $445.3 billion (B) in the latest single quarter ending 4Q23. Revenues for the full-year 2023 were $1,775.8B, down 0.7% YoY over the previous year. In the latest quarter, YoY growth in equipment revenues surpassed service revenues, mainly due to the strong year-end device sales by major telcos such as China Mobile, AT&T, and Deutsche Telekom. At the operator level, five of the top 20 best performing telcos by topline growth for the full-year 2023 include America Movil (7.7%), STC (Saudi Telecom) (7.3%), Airtel (5.0%), Telefonica (4.5%), and Orange (4.3%). By the same criteria, the worst telco growth came from AT&T (5.2%), KDDI (-4.6%), SoftBank (-3.5%), NTT (-3.3%), and Verizon (-2.1%) during the same period.

Capex: Capex spending declined by 4.1% on a YoY basis to post $85.9B in the latest single quarter ending 4Q23. Capex for the full-year 2023 was $315.1B, down 3.6% YoY over the previous year. At the operator level, five of the top 20 best performing telcos by capex growth for the full-year 2023 include Airtel (34.3%), Comcast (25.5%), Charter Communications (18.5%), KDDI (13.1%), and Telefonica (9.9%). By the same criteria, the worst capex growth came from SoftBank (-20.5%), Verizon (-18.7%), Deutsche Telekom (-18.7%), BT (-15.3%), and Reliance Jio (-10.8%) during the same period. Capital intensity is off the peak: it was 17.7% in 2023, from 18.3% the year prior.

Opex and labor costs: Total opex for the telecom industry in the year 2023 stood at $1,504.8B, a decrease of 1.5% over 2022. Excluding depreciation and amortization (D&A) costs, total opex declined by 1.1% on YoY basis to record $1,169.5B in the year 2023. One significant element of telco opex is labor costs, which include salaries, wages, bonuses, benefits, and retirement/severance costs. Labor costs grew by 3.0% YoY in 2023, pushing labor costs as a percentage of opex (excluding D&A) up from 21.6% in 2022 to 22.5% in 2023.

Profitability margins: Both EBITDA and EBIT margins witnessed a slight improvement in the year 2023 when compared to 2022 – EBIT margin grew from 14.6% in 2022 to 15.3% in 2023, while EBITDA (operating) margin ended 2023 at 34.1%, as compared to 33.9% in the previous year.

Regional trends: The Americas region managed to sustain its dominance in 4Q23, with 38.0% global share of the total telco market revenues. On a capex basis though, the Asia region finally surpassed the Americas region with a 39.6% of the global share in the latest quarter. Europe maintained its lead in the latest quarter as the region with the highest annualized capital intensity, reaching 18.7% in 4Q23.

- Table Of Contents

- Figure & Charts

- Coverage

- Visuals

Table Of Contents

- Report Highlights

- Summary

- Market snapshot

- Analysis

- Key stats through 4Q23

- Labor stats

- Operator rankings

- Company Deepdive & Benchmarking

- Country breakouts

- Country breakouts by company

- Regional breakouts

- Raw Data

- Subs & traffic

- Exchange rates

- Methodology & Scope

- About

Figure & Charts

- TNO market size & growth by: Revenues, Capex, Employees – 1Q19-4Q23

- Regional trends by: Revenues, Capex – 1Q19-4Q23

- Opex & Cost trends

- Labor cost trends: 1Q20-4Q23

- Profitability margin trends: 1Q20-4Q23

- Spending (opex, labor costs, capex): annual and quarterly trend

- Key ratios: annual and quarterly trend

- Workforce & productivity trends: 1Q14-4Q23

- Operator rankings by revenue and capex: latest single-quarter and annualized periods

- Top 20 TNOs by capital intensity: latest single-quarter and annualized periods

- Top 20 TNOs by employee base: latest single-quarter

- TNOs: YoY growth in single quarter revenues

- TNOs: Annualized capital intensity, 1Q16-4Q23

- TNOs: Revenue and RPE, annualized 1Q16-4Q23

- TNOs: Capex and capital intensity (annualized), 1Q16-4Q23

- TNOs: Total headcount trends, 1Q16-4Q23

- TNOs: Revenue and RPE trends, 2011-23

- TNOs: Capex and capital intensity, 2011-23 ($ Mn)

- TNOs: Capex and capital intensity, 1Q16-4Q23 ($ Mn)

- TNOs: Revenue and RPE trends, 1Q16-4Q23

- Top 79 TNOs by total opex, 4Q23

- Top 79 TNOs by labor costs, 4Q23

- TNOs: Software as % of total capex

- TNOs: Software & spectrum spend

- TNOs: Total M&A, spectrum and capex (excl. spectrum)

- Top 79 TNOs by total debt: 2011-23

- Top 79 TNOs by total net debt: 2011-23

- Top 79 TNOs by long term debt: 2011-23

- Top 79 TNOs by short term debt: 2011-23

- Top 79 TNOs by total cash and short term investments ($M): 2011-23

Coverage

Operator coverage:

| A1 Telekom Austria | Advanced Info Service (AIS) | Airtel | Altice Europe | Altice USA | America Movil | AT&T | Axiata | Axtel | Batelco |

| BCE | Bezeq Israel | Bouygues Telecom | BSNL | BT | Cable ONE, Inc. | Cablevision | Cell C | Cellcom Israel | CenturyLink |

| Cequel Communications | Charter Communications | China Broadcasting Network | China Mobile | China Telecom | China Unicom | Chunghwa Telecom | Cincinatti Bell | CK Hutchison | Clearwire |

| Cogeco | Com Hem Holding AB | Comcast | Consolidated Communications | Cyfrowy Polsat | DEN Networks Limited | Deutsche Telekom | Digi Communications | DirecTV | Dish Network |

| Dish TV India Limited | DNA Ltd. | Du | EE | Elisa | Entel | Etisalat | Fairpoint Communications | Far EasTone Telecommunications Co., Ltd. | Frontier Communications |

| Globe Telecom | Grupo Clarin | Grupo Televisa | Hathway Cable & Datacom Limited | Idea Cellular Limited | Iliad SA | KDDI | KPN | KT | Leap Wireless |

| LG Uplus | Liberty Global | M1 | Manitoba Telecom Services | Maroc Telecom | Maxis Berhad | Megafon | MetroPCS Communications | Millicom | Mobile Telesystems |

| MTN Group | MTNL | NTT | Oi | Omantel | Ono | Ooredoo | Orange | PCCW | PLDT |

| Proximus | Quebecor Telecommunications | Rakuten | Reliance Communications Limited | Reliance Jio | Rogers | Rostelecom | Safaricom Limited | Sasktel | Shaw |

| Singtel | SITI Networks Limited | SK Telecom | Sky plc | SmarTone | SoftBank | Spark New Zealand Limited | Sprint | StarHub | STC (Saudi Telecom) |

| SureWest Communications | Swisscom | Taiwan Mobile | Tata Communications | Tata Teleservices | TDC | TDS | Tele2 AB | Telecom Argentina | Telecom Egypt |

| Telecom Italia | Telefonica | Telekom Malaysia Berhad | Telenor | Telia | Telkom Indonesia | Telkom SA | Telstra | Telus | Thaicom |

| Time Warner | Time Warner Cable | TPG Telecom Limited | True Corp | Turk Telekom | Turkcell | Veon | Verizon | Virgin Media | Vivendi |

| Vodafone | Vodafone Idea Limited | VodafoneZiggo | Wind Tre | Windstream | Zain | Zain KSA | Ziggo | ||

| Masmovil |

Regional coverage:

| Asia | Americas | Europe | MEA |

Visuals