By Matt Walker

Vendor sales of network infrastructure to the telco vertical (“Telco NI) totaled $55.5B in 1Q22, up 5.7% YoY. On an annualized basis, Telco NI revenues through 1Q22 were $234.8B, the highest total in our 1Q13-1Q22 database and 6.8% higher than the 1Q21 annualized figure. Telco capex has been strong the last few quarters, and vendors are benefiting. For the 2Q21-1Q22 period, telco capex was $327B, up 9.1%.

Some of Telco NI’s recent growth is a bounce back from COVID-plagued 2020, when telco spending weakened. But more of the growth is due to high overall demand. Telcos are spending more on cloud, software, fiber, 5G core, automation, and upgrades to backbone optical and IP networks to support 5G migrations. There is also less supply side competition outside China, with Huawei now frozen out of many country markets; prices and project values are inevitably pushed slightly higher as a result. Inflation worsens this.

Vendors are generally optimistic in their guidance but caution that supply chain shortages persist, and widespread inflation and macroeconomic concerns are major risks in the short term. Ericsson, IBM, Oracle, and Accenture, all top 25 vendors, have already reported 2Q22 results. Accenture continues with strong growth, due in part to acquisitions. Services-focused vendors like Accenture are relatively well positioned to escape the supply chain crunch; cloud providers are in the same boat. But Ericsson, IBM, and Oracle all note that supply chain issues and macroeconomic uncertainty weigh heavily in the short term. Russia’s war on Ukraine also weighs spending in these two markets and adjacent ones, and is responsible for at least part of the current global problem with inflation.

NEPs dominate top 10, but telcos rely on dozens of services, software and connectivity specialists

The top three vendors in the 1Q22 annualized Telco NI market were the largest three traditional “network equipment providers” (NEPs), as usual: Huawei, Ericsson, and Nokia. Their shares in this 12 month period were 18.8%, 11.1%, and 9.0% share, respectively. ZTE, which has been rising lately due in part to Huawei’s challenges, placed fourth with 5.2% annualized share. China Comservice is the largest non-NEP and ended 1Q22 in fifth place; most of its revenues come from Chinese network construction and maintenance projects. Cisco ranked 6, with 4.2%, improved from a year ago (1Q21) but slightly down from CY2021. Intel ranked 7, with 3.1% share. We classify Intel as an NEP, but it is in a class of its own: some of its telco sales are via OEM relationships, and most of the value of its telco offerings are in chips and software. CommScope follows in 8th place. We consider CommScope a connectivity specialist, not an NEP, but it does provide telcos with equipment that goes well beyond connectivity (e.g. small cell baseband controllers). NEC ranked 9 with 2.7% annualized share, with its revenue base a mix of mobile infra, microwave transmission and wireline. NEC has seen share fall a bit recently but it continues to invest heavily to position itself for future open RAN opportunities. The last vendor in the top 10 is Amdocs, considered an IT services provider for this study; its strengths are in telco software and managed services.

While the top 10 accounted for ~64% of revenues, there is a long tail of smaller players with key positions in the telco NI market. In total, this study tracks 132 vendors over the 1Q13-1Q22 period. Some of these are no longer active due to acquisition, privatization, or bankruptcy, but 108 of them were active as of 1Q22. Ninety-one (91) of these had telco NI revenues in excess of $100 million in the 2Q21-1Q22 period. Key suppliers of fiber and connectivity products to telcos (“CCV” specialists), for instance, include CommScope, Hengtong, Corning, and Prysmian, which ranked 8, 13, 14 and 24 overall for the 2Q21-1Q22 period. Ciena and Juniper are powerful in the packet optical market, and ranked 19 and 26 in 2Q21-1Q22, respectively. At the end of the tail, the smallest telco NI vendors within our coverage include Allied Telesis, Net Insight, and Westell, with estimated telco NI revenues of $16M, $9M, and $38M for the 1Q22 annualized period.

Market share changes in 1Q22

Contrasting the 1Q22 and 1Q21 annualized periods, the biggest share gains were captured by Cisco (5G core, backbone upgrades), Samsung (Verizon 5G), Fiberhome (domestic optical), Microsoft (5G core) and Corning (US fiber projects). By the same measure, the biggest share declines were seen at Huawei, Nokia, and Ericsson. Huawei’s declines are multi-year in nature and due largely to supply chain restrictions and political opposition in many key markets. Ericsson and Nokia have naturally seen their share fall after a splurge on 5G RAN spending began to fall off.

Contrasting 1Q22 annualized with calendar year 2021, the changes are slightly different.

Relative to CY2021, the biggest sequential increases in annualized share in 1Q22 came at Intel (which now tracks telco vertical sales in a new “Network and Edge” segment), +0.14% in annualized share; ZTE, which continues to exploit domestic 5G opportunities and overseas accounts that Huawei is locked out of (+0.10%); and Corning, up 0.09% on the back of strong fiber demand worldwide, especially in the US where government subsidy programs have come into play. Corning expects multiyear double digit (percentage) growth in its optical communications division.

Share losers for the 12 months ended March 2022, versus CY21, were Ericsson and NEC (down 0.17% points in annualized share, sequentially, versus CY21), Nokia (down 0.13%), and Cisco (down 0.10%). China Comservice, Huawei and Technicolor have also dipped a bit, as did Dell, but Dell’s dip is due to its VMWare sales being allocated to the stand-alone VMWare entity starting 1Q22. Both Dell and VMWare continue to grow sales to the telco segment, if tracked independent of one another.

Huawei’s annualized share ended 1Q22 at 18.8%, down from 20.2% in the 1Q21 period. The company’s overseas (outside China) sales have dropped markedly as supply chain restrictions and country-level boycotts have hit. It remains easily the largest Telco NI vendor worldwide, though, on the back of its dominance at home, and retains deep pockets and an optimistic outlook on long-term opportunities.

M&A changes to market

Many vendors in our Telco NI database have engaged in M&A in recent quarters, either buying other companies, going private, or selling assets. Most were not transformative, but a few were significant, including:

Ericsson acquired Vonage in 4Q21, a deal which the Swedish vendor hopes to help with 5G monetization. The deal is still under regulatory review as of mid-July 2022.

Ciena acquired AT&T’s Vyatta virtual routing & switching business, in 3Q21, aimed at supporting 5G and edge capabilities.

Cisco acquired Sedona Systems in 2Q21, and closed its purchase of Acacia in 1Q21; both improve Cisco’s position in the optical/IP space for telcos and other types of providers.

NEC acquired 5G radio/software company Blue Danube, in 1Q22, and expects to acquire more telco-focused companies in the coming years

Adtran announced the acquisition of ADVA in 3Q21, combing two important wireline (broadband and optical) vendors; deal closed on July 15, 2022.

Sterlite acquired UK-based Clearcomm, a system integrator, in 3Q21, as part of its efforts to expand beyond connectivity and into new geographies

Tejas sold a controlling stake (43%) in the company to conglomerate Tata Sons in 3Q21, which may finally help it spread its wings

IBM spun off its managed infrastructure services business, as Kyndryl, in 4Q21. Kyndryl is now tracked as a stand-alone company, starting 1Q22.

Dell Technologies spun off its VMWare holdings, also in 4Q21; both companies are now investing heavily to grow in the telco segment. We started tracking VMWare as a stand-alone entity in 1Q22.

Finally, there was one significant acquisition of a vendor by a telco. In 3Q21, Rakuten acquired open RAN specialist software vendor Altiostar. This deal aimed to support Rakuten’s efforts to become an open RAN-focused partner for other telcos. A much smaller telco investment in a vendor came in April 2022, when Verizon invested $40M in supplier Casa Systems, at the same time as committing to a multi-year supply deal.

Telco cloud collaborations continue expanding

As discussed in our recent report, “Telcos Aim For The Cloud By Partnering With Webscale Cloud Providers”, key cloud providers AWS, Azure and GCP are growing their telco vertical revenues. Collectively their telco revenues reached $3B in 1Q22, on a 12 month basis. All three are investing heavily in telco-specific solutions and partnering with telco-focused vendors (e.g. Nokia, Ericsson, Amdocs) to supplement their own offerings. There is also some direct investment in telcos; for instance, Google acquired a 1.28% stake in Indian telco Airtel for $700M in January 2022. Telco cloud collaborations stretch across many areas, with 5G core transformation and new 5G and edge services especially appealing right now. The telco market is one of dozens of vertical markets being attacked by the cloud providers right now, and is not the biggest one. But the cloud providers clearly will continue to impact the market, and expand the range of technical options available to telcos as they evolve their networks.

2022 outlook

We published an update to our telco forecast last month. Per the forecast, we expect telco capex to total about $331B in 2022, a small bump from the 2021 result. This growth should trickle down to the Telco NI vendor market. However, macroeconomic trends remain worrying, and early vendor reports from 2Q22 point to continued supply chain shortages. We are maintaining the forecast outlook but note that there is significant risk in the next 2 quarters.

- Table of Contents

- Figures

- Coverage

- Visuals

Table of Contents

- ABSTRACT – Results commentary

- INTRODUCTION

- Telco NI Market – Latest Results

- TOP 25 VENDORS – Printable Tearsheets

- CHARTS – Single vendor snapshot

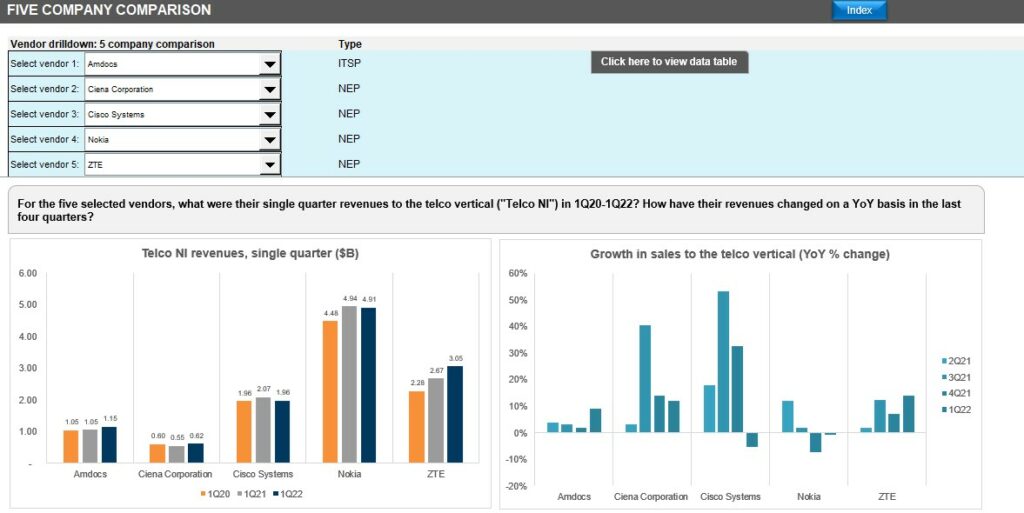

- CHARTS – 5 vendor comparisons

- R&D spending by vendors

- DATA – revenue estimates by company

- ABOUT – MTN Consulting and report methodology

Figures

Partial list:

- Telco NI vendor revenues, annualized (US$B)

- Telco NI revenues by company type, 1Q22 annualized

- Telco NI as share of total company revenues for top 25 vendors

- Telco NI as % of corporate revenues by company type

- Telco NI/Total

- Annualized Telco NI revenues vs. Capex and Opex (ex-D&A)

- Correlation between Telco NI revenues and Capex/Opex ex-D&A

- Annualized Telco NI vendor revenues ($B) vs. YoY growth in single quarter sales

- Telco NI sales of top 6 vendors vs. all others, 1Q22 TTM (annualized)

- Telco NI vendor revenues, YoY % growth in single quarter

- Top 25 vendors based on Telco NI revenues in 1Q22 ($B)

- Top 25 vendors based on annualized Telco NI revenues through 1Q22 ($B)

- Telco NI market share changes, 1Q22 v. 1Q21

- Top 25 vendors based on 1Q22 YoY revenue growth rate in Telco NI

- Top 25 vendors: results highlights and growth outlook

- Top 25 vendors in Telco NI Hardware/Software: Annualized 1Q22 Revenues (US$B)

- Top 25 vendors in Telco NI Services: Annualized 1Q22 Revenues (US$B)

- R&D spending as % of revenues for select Telco NI vendors, 2019-21 average

Coverage

| Company | Segment |

| 3M | CCV |

| A10 Networks | NEP |

| Accenture plc | ITSP |

| Accton Technology | NEP |

| ADTRAN | NEP |

| ADVA Optical Networking | NEP |

| Affirmed Networks | NSP |

| Airspan | NEP |

| Alcatel-Lucent | NEP |

| Allied Telesis | NEP |

| Allot Communications | NEP |

| Alphabet | NSP |

| Altran Technologies | ITSP |

| Amazon | NSP |

| Amdocs | ITSP |

| Anritsu | T&M |

| Arista Networks | NEP |

| ARRIS International | CCV |

| AsiaInfo Technologies | NSP |

| Atos Origin | ITSP |

| Audiocodes | NSP |

| Avaya | ITSP |

| Aviat Networks | NEP |

| Beijing Xinwei | NEP |

| Broadcom Limited | NEP |

| BroadSoft, Inc. | NSP |

| Brocade Communications Systems, Inc. | NEP |

| CA Technologies | NSP |

| Calix | NEP |

| Capgemini | ITSP |

| Casa Systems | NEP |

| Ceragon Networks | NEP |

| Check Point Software | NSP |

| China Comservice | ES |

| Ciena Corporation | NEP |

| Cisco Systems | NEP |

| Citrix Systems | ITSP |

| Clearfield | CCV |

| Comarch | ITSP |

| Comba Telecom | NEP |

| CommScope Holding | CCV |

| Commvault Systems | ITSP |

| Comptel | NSP |

| Convergys | ITSP |

| Coriant | NEP |

| Corning | CCV |

| CSG | NSP |

| Cyan | NSP |

| DASAN Zhone | NEP |

| Datang Telecom Technology | NEP |

| Dell Technologies | NEP |

| DragonWave Inc. | NEP |

| DXC Technology (aka CSC) | ITSP |

| DyCom Industries | ES |

| ECI Telecom | NEP |

| Ericsson | NEP |

| EXFO Inc | T&M |

| Extreme Networks | NEP |

| F5 Networks | ITSP |

| Fiberhome | NEP |

| FireEye | NSP |

| Fortinet | ITSP |

| Fujikura | CCV |

| Fujitsu Limited | NEP |

| Furukawa Electric | CCV |

| General Cable | CCV |

| Harmonic Inc. | NEP |

| HCL Technologies | ITSP |

| Hengtong Optic-electric | CCV |

| Hitachi | NEP |

| HPE | ITSP |

| Huawei | NEP |

| Huber+suhner AG | CCV |

| IBM | ITSP |

| Infinera | NEP |

| Infosys | ITSP |

| Inseego | NEP |

| Intel | NEP |

| Italtel | NEP |

| ITOCHU Techno-Solutions Corporation | ES |

| Juniper Networks | NEP |

| Kathrein | CCV |

| Kudelski | NEP |

| Kyndryl Holdings | ITSP |

| MasTec | ES |

| Mavenir | NSP |

| Metaswitch | NSP |

| Microsoft | NSP |

| Mitsubishi Electric | NEP |

| NEC Corporation | NEP |

| Net Insight | NEP |

| Netcomm | NEP |

| NetScout Systems | NSP |

| Nexans | CCV |

| Nokia | NEP |

| Openet | NSP |

| OPTIVA | NSP |

| Oracle | NSP |

| Pace plc | NEP |

| Palo Alto Networks | NEP |

| Prysmian | CCV |

| Quantenna Communications | NEP |

| Radcom | NSP |

| Radisys | NSP |

| Radware | NEP |

| Red Hat | NSP |

| Ribbon Communications | NEP |

| Ruckus Wireless | NEP |

| Samsung Electronics | NEP |

| SAP SE | NSP |

| SeaChange International, Inc. | NSP |

| Sopra Steria | ITSP |

| Spirent Communications | T&M |

| Sterlite Technologies | CCV |

| Subex | NSP |

| Sumitomo Electric | NEP |

| SYNNEX Corporation | ITSP |

| Tata Consultancy Services | ITSP |

| TE Connectivity | CCV |

| Tech Mahindra | ITSP |

| Technicolor | NEP |

| Tejas Networks | NEP |

| Transmode | NEP |

| Trigiant Group | CCV |

| Virtusa | ITSP |

| VMWare | NSP |

| Vubiquity | ITSP |

| Westell | CCV |

| Wipro | ITSP |

| Wiwynn | NEP |

| YOFC | CCV |

| ZTE | NEP |

Visuals