By Arun Menon and Matt Walker

The goal of this report series is to equip telecom industry decision-makers with a comprehensive view of spending trends and vendor market power in their industry. To do this we assess technology vendors’ revenues in the telecom vertical, across a wide range of company types and technology segments. We call this market “telco network infrastructure”, or “Telco NI.” This study tracks 139 Telco NI vendors, providing revenue and market share estimates for the 1Q13-4Q22 period. Of these 139 vendors, 113 are actively selling to telcos; most others have been acquired by other companies in the database. New vendors added to our coverage in this 4Q22 edition include the following: Akamai, Amphenol, Dynatrace, Lenovo, Nutanix, Rakuten Group, and Ubiquiti.

Telecom operator (telco) revenues records biggest quarterly falloff, capex spend plummeting

The Telco NI market is fueled by spending in the telecom operator (telco) sector, so the financial health and spending patterns of the telco market are worth reviewing.

In 4Q22, the telco industry registered its steepest quarterly falloff in revenues, falling by 9.3% on a YoY basis to record $429.6B. Some of the decline is due to an AT&T spinoff, but the market is still on the decline. Annual revenues stood at $1,779.9B in 2022, down 5.9% over 2021. Declining telco top-line also impacted capex, the main driver for the Telco NI market, which declined by 5.1% YoY to post $87.9B in 4Q22. Despite the end of year spending slump, annual capital intensity reached a new all-time high of 18.1% in 2022. A few countries are starting to scale their just deployed 5G, notably India; many more continue to increase mass market coverage of 5G, and deploy fiber to support fixed broadband and to connect all the new radio infra (including small cells) needed for 5G. There is also a growing number of stand-alone 5G core networks, which is helping the cloud providers improve their penetration into the telco sector. Supply chain constraints continue to impact several vendors, but that is not restraining overall spending levels.

Telco NI YoY revenue growth in 2022 was 1.2%, but -3.7% in 4Q22

Telco NI vendor revenues were $236.0B for the full year 2022 and $61.3B in 4Q22, up 1.2% and down 3.7% on a YoY basis, respectively. The 1.2% annual growth is a big drop from the 7.7% recorded in 2021, when telcos splurged on 5G and on COVID catch-up projects hit by delays in 2020. Telco NI revenues for our entire set of vendors have been flat for most of the last decade, hovering in the $210-220B range in most years, while breaching the $230B barrier in the last two years. The 4Q22 decline in telco NI vendor revenue stems from the big drop in capex spending by key telcos along with a strong US dollar, and macro pressures such as rising interest rates.

Market growth w/ and w/o Huawei has been mixed in the last two quarters. While the total market declined slightly by 1.0% in 3Q22, excluding Huawei it grew by 0.6% in the same quarter. In the latest quarter, the market declined w/ and w/o Huawei by 3.7% and 1.9%, respectively. The company has been weakening in the last 3 years, but very slowly and the trend is offset by its growing market share in its domestic market, China. The company has invested heavily in its software, services and cloud groups to counteract the effect of the bans. Huawei also retains a number of large accounts in big overseas markets, e.g. Etisalat, Telkom South Africa, Orange, and others. Many European telcos remain reluctant to fully close the door on Huawei, and Huawei remains a popular choice in many parts of Asia, MEA, and Latin America.

Most recently, Huawei announced plans to moving its Middle East headquarters to Saudi Arabia. Even as the US prepares to vote on a new bill in the coming week to put more restrictions on Huawei, the company’s lack of access to certain components will hobble it more over the next 2 years, as telcos upgrade IP/optical networks post-5G rollout, and start looking at 5.5G/5G-Advanced.

Top 10 vendors

The top three Telco NI vendors continue to be the usual trio: Huawei, Ericsson, and Nokia. They account for 37.3% of the total market in 2022, or 38.6% in 4Q22 alone. For most of 2016-22, they captured >40% of the market, but Huawei’s share has fallen recently, and new vendors in cloud and IT services space have crowded out the three giants (e.g. Amazon, Microsoft, Alphabet, Dell, VMWare…). Focusing on the top three, Huawei has dropped in the last two periods, but remains dominant due to China. Ericsson’s share decline was a function of lower RAN spending among their largest customers. The Swedish vendor hopes to offset this decline soon with new revenues from its blockbuster acquisition of Vonage. Nokia, including ALU for pre-acquisition years, has also dipped as 5G RAN rollouts slowed. Nokia says its market share is “not reflecting the competitiveness of our products today and tomorrow, because it takes some time to recover some of the losses from the past years in the CSP space.”

China Comservice and ZTE have been trading the 4 and 5 spots off and on since early 2019. Notably, though, China Comservice is majority owned by Chinese telcos, and is not truly independent. Intel is in the 6th position due to data center, virtualization, edge compute and other telco projects, some done directly and some on an OEM basis. CommScope also managed to surpass Cisco in the latest annualized 4Q22 period, as Cisco (8th position) witnessed a stark drop in its revenues in 4Q22. Cisco’s decline is worrying, as its largest market (the US) saw strong capex and a growing focus on 5G core, which Cisco has flagged in the past as key to the company growing telco revenues. NEC and Amdocs rank 9-10, due to strength in connectivity, Japan (and global microwave), and network software, respectively.

Biggest Telco NI revenue changes on a YoY basis

New vendor Rakuten recorded the best growth for the annual (2022) and quarterly (4Q22) periods. Rakuten Symphony’s Telco NI revenues in 2022 were ~$390 million, over 4x the 2021 figure, while its 4Q22 revenues were $180M, up 193.5% YoY. All the three cloud providers (Alphabet, Microsoft, and Amazon) feature among the top five vendors with biggest annual revenue growth in 2022 as they have been steadily improving their penetration of the telco vertical with a range of solutions – digital transformation, service design, 5G core, workload offshift, etc. All these cloud vendors also made big revenue gains of +50% on a YoY basis in 4Q22.

Looking at other vendors, Clearfield is an anomaly, as it’s a small fiber company focused on the US market; a small portion of its 2022 gains came from an acquisition (Nestor Cables). IT service provider, VMware, posted strong revenue growth of 90.3% YoY in 4Q22 as it is assisting telcos in improving the overall customer experience and driving operational excellence amid declining top-line. Harmonic is another vendor to post robust revenue gains in both the periods, as it has benefited from strong cable access spending and a growing customer list. Other companies to show improvement in both periods include YOFC (a Chinese fiber company), and the US-based engineering services-focused company benefiting from a fiber boom, MasTec. Calix also saw strong gains in both the periods, driven by “broadband service providers that are providing broadband as a service rather than just the dumb pipe”.

Declines in the full-year 2022 include NEC (Yen depreciation and weaker capex in Japan), Airspan (“supply chain challenges continue to be dominated by long lead times and transportation availability”), Casa (cites supply chain), and Cisco (lumpy customer capex). NEC and Cisco, the two of the largest annualized decliners, remain optimistic about prospects as telcos move to 5G SA cores, and open RAN in particular for NEC. NEC’s recent acquisitions in the space: Aspire Tech, Blue Danube.

Supply chain constraints easing

A review of vendor earnings from 4Q22 suggests that supply chain constraints are still an issue, but are improving. Many vendors have noted ongoing shortages, discussing “mitigation efforts” like redesign of products and payment of expedite fees. But most significant vendors confirm the assessment of three months ago: shortages in specific component areas continue to be an issue but are improving with time, with normalcy likely in 2H23. Here are a few company rep comments from recent vendor earnings calls, with an emphasis on the negative to make clear there are still current issues:

Arista: “While we experienced some improvement in overall component supply in the quarter, shipments remained somewhat constrained with lingering shortages on a handful of parts.”

Calix: “While the supply chain environment is improving in some areas, the challenging areas remain unpredictable and result in surprises. Lead times remain extended, decommits still happen and sourcing components in the secondary markets require extraordinary effort. We continue to expect the supply chain environment to be challenging through 2023.”

Ciena: “While supply chain has not completely recovered, and there is still some volatility in component deliveries, we are encouraged by the component availability in Q1 and our related strong shipment performance. This is both, I think, a proof point of our mitigation efforts and a positive indicator of our expectation for continued gradual improvements in the supply environment as we move through the year.”

Cisco: “While components for a few product areas remain highly constrained, we did see an overall improvement. Combined with the aggressive actions our supply chain and engineering teams took to redesign hundreds of our products, we increased product deliveries and saw significant reductions in customer lead times. As our product deliveries increased, channel inventories also declined as our partners were able to complete customer projects…as supply constraints ease and lead times shorten, we expect orders [will] normalize from previously elevated levels as customers return to more typical buying patterns.”

Ericsson: “…we’ve seen supply chain easings that enable some operators to optimize their inventories…I think we should remember that this was a year with significant global challenges when it comes to supply chain. And of course, that has impacted our working capital. So what happened in [4Q22] was that now as the supply chain situation globally is easing up, we were able to reduce the inventory just as we said would happen, exactly that happened as well. So that’s good, both in component, but also in project inventory.”

Juniper: “Supply chain continues to be constrained with long lead times and elevated costs. If not for the elevated supply chain costs, we estimate that we would have posted [a higher] non-GAAP gross margin of approximately 60%.”

Commentary from Taiwan-based TSMC, the world’s largest chip fab, points at improvement: “As customers and the supply chain continue to take action, we forecast the semiconductor supply chain inventory will reduce sharply through first half 2023, to rebalance to a healthier level…”. That said, there continues to be a worst-case scenario that can’t be ignored: China-Taiwan conflict. Supply chains in telecom, like the rest of tech, rely heavily on semiconductors produced in Taiwan. A war between China and Taiwan would create supply chain problems far worse than what we’ve seen in the last two years.

Spending outlook

Most large vendors appear to be cautiously optimistic about the spending outlook in Telco NI. Many point to supply chain constraints as limiting recent growth, but there is an expectation that these will clear up by 2Q or 3Q 2023. However, MTN Consulting expects the market will start to flatten in the next few quarters. Officially we expect telco capex – the main driver of Telco NI market – to reach $330B in 2023, and a small decline to $325B in 2024. It’s likely that both figures may be $5B or more too high. Lower expectations have been apparent on many 4Q22 telco earnings calls. DT, for instance, now says its US capex will see a “strong decrease” in 2023, and thereafter stability. Verizon’s capex is set to fall nearly 20% YoY in 2023. Charter Communications cut its capex outlook for 2023 by about $500M, hitting both the low & high range. Orange expects a “strong decrease” (same wording) in total “ecapex” this year as its FTTH deployment peak has passed and it aims to increase its dividend. Canada’s BCE says that 2022 was the peak year in its accelerated capex program, and capex will begin to fall this year until capital intensity is back down to pre-COVID levels. Vodafone expects group capex in its current fiscal year to be flat to slightly down, as it pursues a “disciplined approach to capital allocation.” Telefonica says its declining capital intensity is proof that the investment peak is behind it. The MTN Group says capital intensity will decline from 18% to 15% over the next few years.

There are several factors to help explain lower expectations: some are company-specific, e.g. BCE is naturally reaching a latter phase in its buildout. There are also general factors, such as: rising interest rates (up again last month, with signals of more increases to come); higher operating costs due to inflation, especially in energy; 5G’s failure to lift service revenues, leaving telcos highly dependent on volatile device revenues for any topline growth; and, cloud providers’ continually more aggressive to pitch new solutions to telcos, which can shift some capex to opex.

We will provide a formal forecast update in 2Q23.

- Table of Contents

- Figures

- Coverage

- Visuals

Table of Contents

- ABSTRACT – Results commentary

- Telco NI Market – Latest Results

- TOP 25 VENDORS – Printable tearsheets

- CHARTS – Single vendor snapshot

- CHARTS – 5 vendor comparisons

- R&D spending by vendors

- RAW DATA – revenue estimates by company

- Methodology & Assumptions

- ABOUT – MTN Consulting

Figures

Partial list:

- Annualized Telco NI vendor revenues ($B) vs. YoY growth in annualized sales

- YoY growth in annualized Telco NI market, with and without Huawei figures

- All vendors, YoY growth in single quarter sales

- Telco NI vendor revenues by company type, TTM basis (US$B)

- Telco NI revenues by company type: YoY % change

- Telco NI revenue split: Services vs. HW/SW

- Telco NI sales of top 10 vendors vs. all others, 4Q22 TTM (annualized)

- Top 25 vendors based on annualized Telco NI revenues through 4Q22 ($B)

- Top 25 vendors based on Telco NI revenues in 4Q22 ($B)

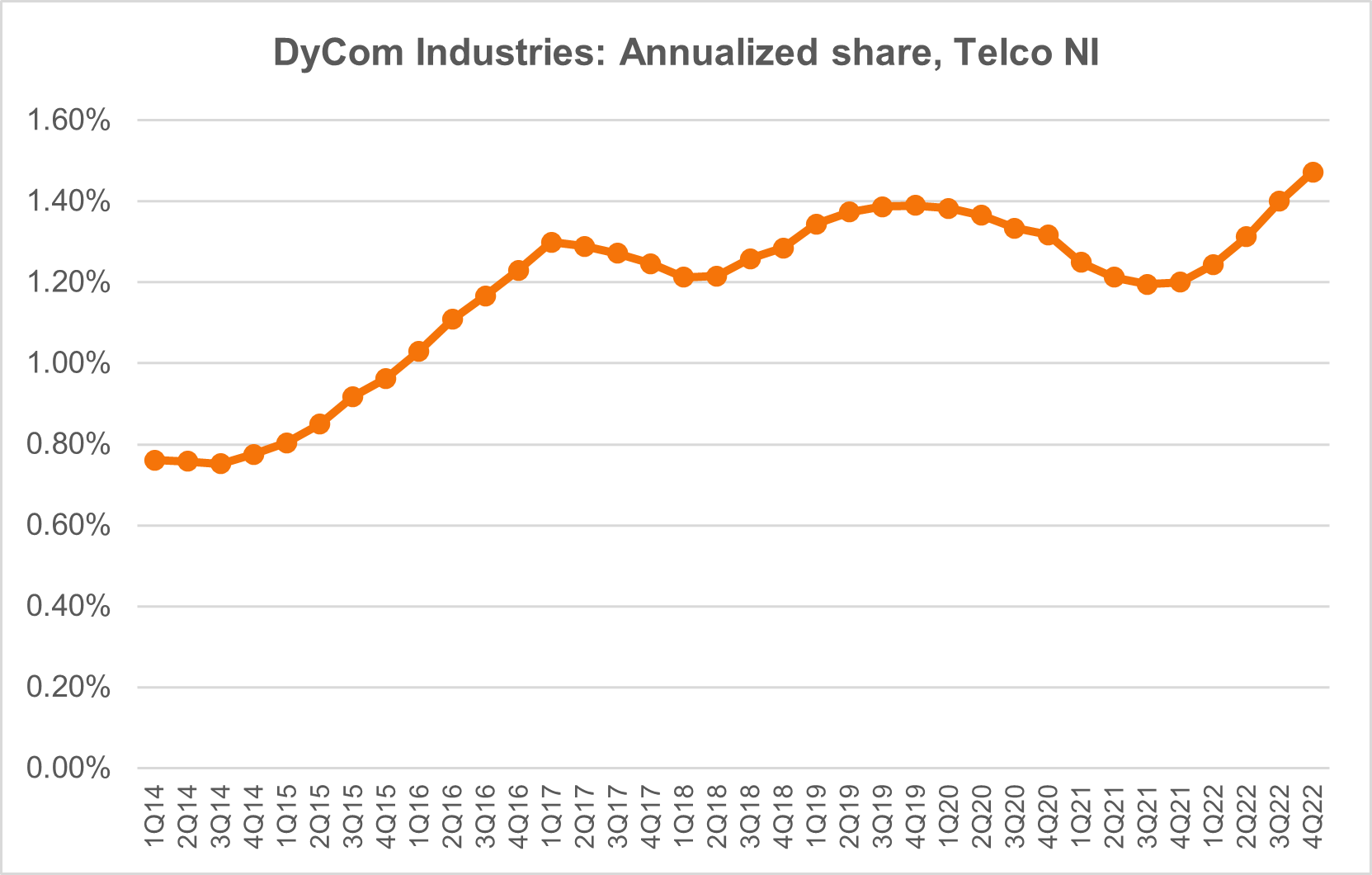

- Key vendors’ annualized share of Telco NI market

- Telco NI market share changes, 4Q22 TTM vs. 4Q21 TTM

- Telco NI annualized revenue changes, 4Q22 vs. 4Q21

- YoY growth in Telco NI revenues (4Q22)

- Top 25 vendors in Telco NI Hardware/Software: Annualized 4Q22 Revenues (US$B)

- Top 25 vendors in Telco NI Services: Annualized 4Q22 Revenues (US$B)

- R&D spending as a percent of revenues for key telco-focused vendors (4Q21-4Q22)

Coverage

| Company | Segment |

| 3M | CCV |

| A10 Networks | NEP |

| Accenture plc | ITSP |

| Accton Technology | NEP |

| ADTRAN | NEP |

| ADVA Optical Networking | NEP |

| Affirmed Networks | NSP |

| Airspan | NEP |

| Akamai | NSP |

| Alcatel-Lucent | NEP |

| Allied Telesis | NEP |

| Allot Communications | NEP |

| Alphabet | NSP |

| Altran Technologies | ITSP |

| Amazon | NSP |

| Amdocs | ITSP |

| Amphenol | CCV |

| Anritsu | T&M |

| Arista Networks | NEP |

| ARRIS International | CCV |

| AsiaInfo Technologies | NSP |

| Atos Origin | ITSP |

| Audiocodes | NSP |

| Avaya | ITSP |

| Aviat Networks | NEP |

| Beijing Xinwei | NEP |

| Broadcom Limited | NEP |

| BroadSoft, Inc. | NSP |

| Brocade Communications Systems, Inc. | NEP |

| CA Technologies | NSP |

| Calix | NEP |

| Capgemini | ITSP |

| Casa Systems | NEP |

| Ceragon Networks | NEP |

| Check Point Software | NSP |

| China Comservice | ES |

| Ciena Corporation | NEP |

| Cisco Systems | NEP |

| Citrix Systems | ITSP |

| Clearfield | CCV |

| Comarch | ITSP |

| Comba Telecom | NEP |

| CommScope Holding | CCV |

| Commvault Systems | ITSP |

| Comptel | NSP |

| Convergys | ITSP |

| Coriant | NEP |

| Corning | CCV |

| CSG | NSP |

| Cyan | NSP |

| DASAN Zhone | NEP |

| Datang Telecom Technology | NEP |

| Dell Technologies | NEP |

| DragonWave Inc. | NEP |

| DXC Technology (aka CSC) | ITSP |

| DyCom Industries | ES |

| Dynatrace | NSP |

| ECI Telecom | NEP |

| Ericsson | NEP |

| EXFO Inc | T&M |

| Extreme Networks | NEP |

| F5 Networks | ITSP |

| Fiberhome | NEP |

| FireEye | NSP |

| Fortinet | ITSP |

| Fujikura | CCV |

| Fujitsu Limited | NEP |

| Furukawa Electric | CCV |

| General Cable | CCV |

| Harmonic Inc. | NEP |

| HCL Technologies | ITSP |

| Hengtong Optic-electric | CCV |

| Hitachi | NEP |

| HPE | ITSP |

| Huawei | NEP |

| Huber+suhner AG | CCV |

| IBM | ITSP |

| Infinera | NEP |

| Infosys | ITSP |

| Inseego | NEP |

| Intel | NEP |

| Italtel | NEP |

| ITOCHU Techno-Solutions Corporation | ES |

| Juniper Networks | NEP |

| Kathrein | CCV |

| Kudelski | NEP |

| Kyndryl Holdings | ITSP |

| Lenovo | NEP |

| MasTec | ES |

| Mavenir | NSP |

| Metaswitch | NSP |

| Microsoft | NSP |

| Mitsubishi Electric | NEP |

| NEC Corporation | NEP |

| Net Insight | NEP |

| Netcomm | NEP |

| NetScout Systems | NSP |

| Nexans | CCV |

| Nokia | NEP |

| Nutanix | NSP |

| Openet | NSP |

| OPTIVA | NSP |

| Oracle | NSP |

| Pace plc | NEP |

| Palo Alto Networks | NEP |

| Prysmian | CCV |

| Quantenna Communications | NEP |

| Radcom | NSP |

| Radisys | NSP |

| Radware | NEP |

| Rakuten Group | NSP |

| Red Hat | NSP |

| Ribbon Communications | NEP |

| Ruckus Wireless | NEP |

| Samsung Electronics | NEP |

| SAP SE | NSP |

| SeaChange International, Inc. | NSP |

| Sopra Steria | ITSP |

| Spirent Communications | T&M |

| Sterlite Technologies | CCV |

| Subex | NSP |

| Sumitomo Electric | NEP |

| SYNNEX Corporation | ITSP |

| Tata Consultancy Services | ITSP |

| TE Connectivity | CCV |

| Tech Mahindra | ITSP |

| Technicolor | NEP |

| Tejas Networks | NEP |

| Transmode | NEP |

| Trigiant Group | CCV |

| Ubiquiti | NEP |

| Virtusa | ITSP |

| VMWare | NSP |

| Vubiquity | ITSP |

| Westell | CCV |

| Wipro | ITSP |

| Wiwynn | NEP |

| YOFC | CCV |

| ZTE | NEP |

Visuals