By Matt Walker

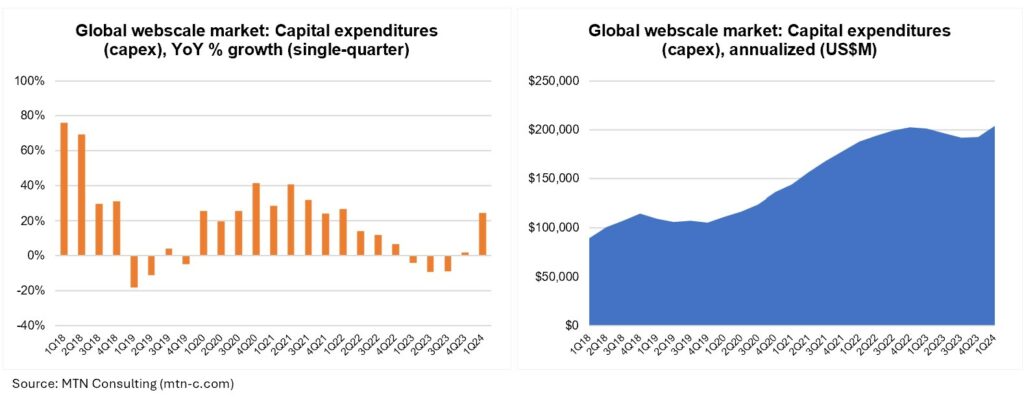

This report reviews the growth and development of the webscale network operator (WNO) market since 2011. In the most recent 12 months (2Q23-1Q24), webscalers represented $2.42 trillion (T) in revenues (+7.6% YoY), $295 billion (B) in R&D spending (+5.5% YoY), and $204B in capex (+1.5% YoY). They had $658B of cash and short-term investments (+4.0% YoY) on the books as of March 2024, and $550B in total debt (+0.2% YoY). Webscalers employed approximately 4.161 million (M) people at the end of 1Q24, up a bit from the March 2023 total of 4.080M.

Webscalers maintain growth momentum in 1Q24

During COVID, the webscale sector expanded dramatically, with revenue growth of 18% and 25% in 2020 and 2021, respectively. The following two years saw a reversal, with 4 and 6% growth rates. So far, 2024 looks promising: revenues rose by 8.1% YoY in 1Q24. Annual revenue growth of between 5-10% growth in the industry is likely to persist. Global economic growth has improved, the digital ad market is recovering, cloud services penetration marches on, TikTok is facing backlash, Huawei’s device business remains in the doldrums, and – perhaps most importantly – the sector is enthusiastic about opportunities surrounding Generative AI. All factors tend to benefit the revenue growth measured by our webscale tracker.

By company, not every webscaler is growing. Apple’s revenues dipped 4.3% on a YoY basis in 1Q24, while Baidu saw revenues fall 3.3% YoY. Apple’s revenues regularly swing up and down with product introductions and network upgrades, though. Baidu’s outlook is improving, as its ERNIE AI platform matures and autonomous vehicle opportunities expand. More important, the giants of the sector are all growing like weeds; Meta revenues surged by 27% in 1Q24, followed by Microsoft (17%), Alphabet (15%), and Amazon (13%).

Revenues per employee in the webscale sector ended 1Q24 at $592K, from $544K in 1Q23; free cash flow per employee jumped even more noticeably, from $79K in 1Q23 to $112K in 1Q24. These swings are due both to rising revenues and even more quickly rising profits, and the sector’s headcount growth easing in the last two years. Webscale headcount ended 1Q24 at 4.161M, up only slightly from the 1Q22 total of 4.140M. The small webscalers JD.Com and Yandex both saw double digit employment growth between 1Q23 and 1Q24, but several others saw erosion: Alibaba (-12.9%), Meta (-10.1%), Alphabet (-5.1%) Baidu (-3.6%), and Tencent (-1.1%). The sector will see additional layoffs as big webscalers attempt to implement Generative AI in their own operations in search of labor cost savings. The same thing is already happening in the telco sector.

Tech spending: capex surges 25% YoY in 1Q24 as webscalers expand GenAI efforts; R&D spend remains elevated

Generative AI has captured the public’s imagination, and is covered endlessly by tech and financial journalists. There appears to be a land grab to build GenAI models as fast as possible. Webscalers have ramped up data center spending dramatically. That has directly benefited one specific chip vendor, NVIDIA, as the race to train models accelerates. Suddenly this company has a market cap just below that of Microsoft and Apple. Is any of this sustainable? Does NVIDIA have some sort of first mover advantage? Do the webscalers currently blanketing the world with AI-centric data centers have such an advantage?

The current hype will almost inevitably die down soon. Competitors will catch up, the dark side of GenAI will become more apparent (and regulated), other sectors will attract investments. China’s behind the scenes work to develop “homegrown” alternatives (on the chip and GenAI model fronts) will bear more tangible fruit. The parallel threats to Taiwan’s independence will get more severe. You can’t just view the future through rose-colored glasses.

Total capex for the four quarters ended 1Q24 was $204B, up 1.5%. For 1Q24 alone, capex was $56.9B, up a whopping 24.7%. Moreover, the tech piece of capex has been surging: Network/IT and software capex for webscalers was about $35.4B in 1Q24, up 53%. That is unlikely to be the norm, to be clear. Capex is volatile in the webscale sector and driven by just a few big players; the top 4 captured 78% of 1Q24 annualized tech capex. But the prospects for 2024 are strong.

R&D spend within webscale has amounted to over 12% of revenues for the last 6 quarters, ending 1Q24 at 12.2%. The R&D intensity ratio has been creeping up in webscale for some time, as companies spend heavily to enter into new markets such as robotics, healthcare, financial services, and more. A good chunk of this R&D cash also targets the development of proprietary tech for the physical infrastructure of data centers underlying their operations: new chips and other hardware, not just smarter software. This is always on the mind of the big suppliers to the webscale sector: the risk that they’ll be replaced by a homegrown alternative emerging out of the webscalers’ enormous R&D budget. Until it happens, the risk will likely be underappreciated in public expectations.

GenAI – webscale’s new lifeforce

For the last several years, adoption of cloud services was a primary motivator for incremental investments; they drove data center spread and design evolution at Alphabet, Amazon, Microsoft and Oracle. Short-form video content and gaming were also important drivers. This could be seen in the big related investments made by Alphabet and Meta, and Microsoft’s biggest acquisition ever (of Activision, for $69B). Then in early 2023 – alongside these other trends – GenerativeAI’s potential suddenly reached mass market awareness. In reality, GenAI was cooking for many years prior to this, but January 2023 was a turning point with the release of ChatGPT: it reached 100 million users by the end of the month. Other platforms were rushed to market, and any big tech company (webscaler or not) without investments in GenAI quickly scurried around to cobble something together, or invest in a third party. Amazon, for instance, invested heavily in Anthropic, as did Alphabet. Chinese webscalers each launched their own native offerings.

There is surely some unrealistic hype being floated about the potential of GenAI to solve all the world’s problems – cure diseases, find solutions to global conflict, invent new forms of transportation, etc. This happens every time markets get excited about a new technology. There is always a ‘tech leader’ willing to make obnoxiously grandiose statements, and a receptive audience to echo some of the nonsense. That said, GenAI has real potential to develop new markets over the next few years, and it is a legitimate reason to accelerate data center investments. The exact shape and size and location of such investments are not yet clear, and that uncertainty can slow down investment. But GenAI is not going away. We suspect the quest to monetize GenAI will drive a land grab for more capable data centers and supporting supercomputer clusters for several years to come.

US accounts for over 50% of webscale capex

This report series traditionally breaks out revenues by region for each webscaler. Towards the end of 2023, we added our first regional breakout of capex, focused on the US. Our analysis finds that the US has amounted to between 50-60% of global webscale capex for most of the last decade. This percentage increased in the last two years, ending 2023 at just over 60%. The US will continue to be the largest single country market, by far, for the foreseeable future. Most of the key GenAI innovators are based in the US and rely heavily on US Internet infrastructure, and data center capex will follow this pattern. However, the US ratio may return below 50% within a couple of years as webscalers expand their footprints in other regions. Spending pickups by China-based cloud providers will be one driver of this moderation. Alibaba and Tencent plan big investments, as does Huawei Cloud (not covered here).

Webscale market compared to telecom

A decade ago, the webscale sector did not exist. Big tech companies were just beginning to build their own data centers to optimize their cost structure, operational efficiency, and time to market. But webscale capex was a rounding error in the overall market for network infrastructure. That’s not the case anymore. Webscale capex surpassed $200B for the first time in 2022. Annualized webscale capex has since fallen below $200B, but that is a short-term blip.

Telco capex is still higher, and will remain so for the next few years. But, webscale capex is far more concentrated, as it is dominated by a few big spenders, and it is focused on a smaller range of product types and vendors. Some aspects of webscale capex are more leading edge; innovations in the data center often impact other types of networks (e.g. high-speed optics for telco backbone networks). As such, the market will continue to be important for lots of vendors – and not just chip suppliers like NVIDIA, Intel and AMD.

Spending outlook

Virtually all webscalers are citing GenAI enthusiasm as a driver to spend heavily on expansion of their data center footprints and acceleration of moves into high-powered computing. There is some gamesmanship at play, as nobody wants to appear to be the slow mover. There is widespread excitement about the potential for new applications that GenAI brings, even though it hasn’t yet created lots of new revenue streams. There is also concern about availability of chips needed for model training. Markets will stabilize in the next 2-3 quarters. NVIDIA will remain an important company in the webscale space, but its recent growth trajectory will likely prove to be a blip and wildly unsustainable. Here is a summary of the spending outlook for key webscalers:

Amazon (1Q24 capex of $14.9B, up 5% YoY): “We expect [1Q24] to be the low quarter for the year…We anticipate our overall capital expenditures to meaningfully increase year-over-year in 2024, primarily driven by higher infrastructure CapEx to support growth in AWS, including generative AI.”

Alphabet ($12.0B, up 91% YoY): “we expect quarterly CapEx throughout the year to be roughly at or above the Q1 level…We have already served billions of queries with our generative AI features…At Google Cloud Next, more than 300 customers and partners spoke about their generative AI successes with Google Cloud, including global brands like Bayer, Cintas, Mercedes Benz, Walmart and many more.”

Microsoft ($11.0B, +66% YoY): won’t address analyst speculation of a potential $100B year, but does say that “…we have been doing what is essentially capital allocation to be a leader in AI for multiple years now, and we plan to sort of essentially keep taking that forward.”

Meta ($6.4B, -6% YoY): “We anticipate our full year 2024 capital expenditures will be in the range of $35 billion to $40 billion, increased from our prior range of $30 billion to $37 billion as we continue to accelerate our infrastructure investments to support our AI road map.”

Tencent ($2.0B, +211% YoY): no guidance but clearly says its capex surge is due to “investment in GPUs and servers to support our Hunyuan and AI ad recommendation algorithms.”

Apple ($2.0B, -32% YoY): emphasis on ability to share capex with third-parties (in carrier-neutal sector) and plans to buy back stock and raise dividends. “on the CapEx front, we have a bit of a hybrid model where we make some of the investments ourselves. In other cases, we share them with our suppliers and partners. …We have our own data center capacity and then we use capacity from third parties. It’s a model that has worked well for us historically, and we plan to continue along the same lines going forward.”

Oracle ($1.7B, -36% YoY): 1Q24 was light due to timing of payments but capex flows will accelerate in 2Q24, reaching as much as $3B as it expands cloud capacity.

Alibaba ($1.6B, +207% YoY): no guidance but says “Starting in 2024, we’ve seen a rapid increase in customer demand for AI. It has also stimulated growth in demand for traditional cloud computing needs, including general computing storage and big data. Therefore, we are actively investing in our cloud computing product matrix, especially in AI infrastructure to capture the monumental opportunities…Looking ahead, we will deeply integrate our Tongyi large model with Alibaba Cloud’s advanced AI infrastructure to realize synergies and optimization across software and hardware.”

Baidu ($284M, +50% YoY): “We believe that chips we have in hand are sufficient to support the training of ERNIE for the next 1 or 2 years. And because of the limited availability of high-performance chips in China in this year 2024, we expect that our CapEx to be smaller versus last year…Our reserve and access to the chips on the market should be sufficient for us to support millions of AI applications in the future.

Forecast outlook

Our Dec 2023 forecast called for $202B in 2023 webscale capex; the actual total was a bit lower, $193B. Since the turn of the year, though, key webscalers have accelerated data center investments with a focus on building out training and inference capabilities for GenAI. Spending outlook for 2024 and even 2025 has increased. As such, in April 2024, we alerted clients to a need to upgrade the spending outlook slightly.

It is unlikely for the rapid capex growth rate of 1Q24 to persist throughout the year. There are some supply side constraints in the availability of GPUs, and there are also some energy supply constraints. Powering all these new data centers will require huge amounts of new electricity supply, and most webscalers have ambitious carbon neutrality goals. It will take some time for adequate renewables to become available. Further, the hype around GenAI may die down a bit as the focus turns to business models and return on investment. Last year, we called for 2024 and 2025 capex spend of $203B and $218B respectively. Now, though, we expect the GenAI hype will push spending up by another $10-20B. We will be more specific in our upcoming forecast update.

- Table Of Contents

- Figures & Charts

- Coverage

- Visuals

Table Of Contents

- Abstract

- Analysis

- WNO Market: Key Stats

- Company Drilldown

- Top 8 WNOs

- Company Benchmarking

- Regional Breakouts

- Raw Data

- Exchange Rates

- About

Figures & Charts

- Key Metrics: Growth rates, Annualized 1Q24/1Q23 vs. 2019-23

- WNO Revenues: Single-quarter & annualized (US$M)

- Top 8 WNOs: YoY revenue growth in 1Q24

- Annualized profitability: WNOs

- Free cash flow per employee, 1Q24 annualized (US$)

- FCF Margins vs. Net Margins, 1Q24 annualized

- Advertising revenues as % total (FY2023)

- Annualized capex and R&D spending: WNOs (% revenues)

- WNO capex by type, Annualized: 1Q15-1Q24 (US$M)

- Network & IT capex as share of revenues, 1Q24 annualized

- R&D expenses as % revenues, Top 8 WNOs (1Q24 annualized)

- Acquisition spending vs. capex spending, annualized (US$M)

- Net PP&E per employee (US$’ 000) – 1Q24

- Ranking the Webscale Network Operators: Revenues; R&D; Capex; Network & IT capex – 2023 & 1Q24 (US$B)

- Annualized spending share for key webscalers since 2011 Capex: Network, IT and software

- Share of webscale spending by company, 1Q24 and 1Q23 annualized (Capex: Network, IT and software)

- Energy consumption vs. Net PP&E for key webscalers in 2022

- USA: Webscale capex total ($M) and % of global market, 2011-23

- Webscale vs. Telco Market: Annualized Capex (US$B)

- Webscale vs. Telco Market: Annualized capital intensity

- Revenues: annual, single-quarter, and annualized (US$M)

- Profitability (Net Profit; Cash from operations; Free cash flow): annual, single-quarter, and annualized (US$M)

- Spending (R&D; M&A; Capex; Network & IT capex; Lease): annual, single-quarter, and annualized (US$M)

- Cash & Short-term Investments: annual and single-quarter (US$M)

- Debt (Total debt; Net debt): annual and single-quarter (US$M)

- Property, Plant & Equipment: annual and single-quarter (US$M)

- Key Ratios: Net margin; R&D/revenues; Capex/revenues; Network & IT capex/revenues; Free cash flow/revenues; Lease costs/revenues – annual and annualized (%)

- Total employees

- Revenue per employee, annualized (US$K)

- FCF per employee, annualized (US$K)

- Net PP&E per employee, annualized (US$K)

- Revenues & Spending (US$M)

- Webscale Business Mix by Revenues (FY2023) – MTN Consulting estimates

- Top 10 recent acquisitions & investments

- Data center footprint

- Revenues (US$M) & YoY revenue growth (%), single-quarter: by company

- Revenues, annualized (US$M): by company

- Annualized profitability margins: by company

- Annualized capex and capital intensity: by company

- Annualized capex and R&D spending as % of revenues: by company

- Share of WNO network & IT capex, Annualized: by company

- Total employees: by company

- Annualized per-employee metrics (US$000s): by company

- Net debt (debt minus cash & stock) (US$M): by company

- Top 10 webscale employers in 1Q24: Global market

- Headcount changes in 1Q24 (YoY %): Global market

- Net PP&E: USA vs. RoW (by company)

- Net PP&E: total in $M and % global webscale market (by company)

- Energy consumption, MWh and % webscale total (by company)

- Share of webscale energy consumption, net PP&E, and capex (by company)

- Energy intensity relative to webscale average and select data center-focused CNNOs (by company)

- Energy intensity in webscale sector, 2023: MWh consumed per $M in revenue

- Capex/revenues (annualized): Company vs. Webscale average

- Revenue per employee (US$000s) (annualized): Company vs. Webscale average

- 2017 vs. 2023: company benchmark by KPI (Revenues, R&D, Net profit, Cash from operations, Capex, Free cash flow, Cash & short-term investments, Net PP&E, Total debt)

- 2017 vs. 2022: company benchmark by key ratio (Capex/revenues; R&D/revenues; Net margin; FCF margin)

- Top 8 WNO’s share vs. Rest of the market: by KPI (Revenues, R&D, Net profit, Cash from operations, Capex, Free cash flow, Cash & short-term investments, Net PP&E, Total debt)

- Top 8 WNOs benchmarking by Key ratio: Capex/revenues; R&D/revenues; Net margin; FCF margin)

- Total WNO Market Revenues, by region: Latest CY; Latest Quarter; Annual trend (2011-23); Single quarter (1Q15-1Q24 )

- WNO Market: Revenues, single-quarter (YoY % change)

- Regional revenues by operator: Latest CY; Latest Quarter; Annual trend (2011-22); Single quarter (1Q15-1Q24)

- Top 10 operators by region: Latest CY; Latest Quarter

Coverage

| Top 8 WNOs | |||

| Alibaba | Alphabet | Amazon | Apple |

| Baidu | Meta (FB) | Microsoft | Tencent |

| Other WNOs | |||

| Altaba | ChinaCache | Cognizant | eBay |

| Fujitsu | HPE | IBM | JD.com |

| Oracle | SAP | ||

| Yandex | |||

Visuals