By Matt Walker

This report reviews the growth and development of the webscale network operator (WNO) market since 2011. In the most recent 12 months (4Q22-3Q23), webscalers represented $2.32 trillion (T) in revenues (+3.7% YoY), $289 billion (B) in R&D spending (+13.1% YoY), and $192B in capex (-3.8% YoY). They had $710B of cash and short-term investments (+16.2% YoY) on the books as of September 2023, and $562B in total debt (+3.1% YoY). Webscalers employed approximately 4.099 million (M) people at the end of 3Q23, slightly up from 2Q23 but down 1.6% from September 2022.

Revenues up 7% YoY in 3Q23, to $578B

The webscale market skyrocketed during COVID. In 1Q20, when COVID first emerged, annualized revenues were just under $1.5 trillion. Just 6 quarters later, in 3Q21, the sector reached the $2 trillion mark. This stunning growth moderated in 2022 due to macroeconomic issues, weak ad sales, and China’s slow growth and ongoing constraint of the tech sector. The market is picking up again in 2023, however, as annualized revenues hit $2.32 trillion in 3Q23, up 7.2% YoY.

By company, all top 8 webscalers grew single quarter revenues YoY in 3Q23, with the exception of Apple. Its revenues are cyclical, though, impacted by device refreshes and upgrade cycles. Amazon and Meta were the biggest positives in 3Q23. Amazon’s 3Q23 revenues were $16B higher than 3Q22, or up 12.6% on a percentage basis; Meta’s revenues grew $6.4B vs. 3Q22, or up by 12.8%. Microsoft and Alphabet also saw double digit revenue growth rates in 3Q23, while China’s webscalers remain in a holding pattern of sluggish growth. They have also been impacted by US restrictions on technology procurement.

Technology spending: R&D still rising, capex growth pauses

In 3Q23, webscalers spent $48.0B and $72.2B on capex and R&D, respectively.

For capex, the result represents the second consecutive 9% YoY decline. We have already issued a revised forecast alert, and expect full year capex to come in about 5-10% lower than projected. None of the key webscalers are in trouble, and all expect future growth in capex, with generative AI an additional driver for investment. For R&D, actual spending in 3Q23 was 4.7% higher than 3Q22; however, for once R&D spend grew more slowly than revenues, pushing 12 month R&D intensity down slightly, to 12.4% of revenues. Generative AI is one of many focal points for webscale R&D. Webscalers are also spending heavily on R&D to develop their own chips and customized data center designs.

The tech portion of capex (“Network, IT and software”) has grown as a % of total recently, but other capex (mostly related to land & buildings) is still comfortably over 50% of total. For the four quarters ended 3Q23, Network/IT/software accounted for $90B of the $192B total. Tech grew YoY in 3Q23, while other capex declined.

From a separate MTN Consulting study, we found that energy consumption by webscalers in 2022 grew about 16% YoY, to 136.6 terawatt hours (TWh). That growth exceeds the 3% and 7% recorded by the telco & carrier-neutral sectors, respectively. Webscale energy consumption is driven primarily by the sector’s installed base of data centers, which has expanded dramatically in the last 3 years: net PP&E on the books totaled $397B in 3Q20, and reached $679B just 3 years later in 3Q23.

In sustainability matters, one important recent development is bad news for Amazon. In September 2023, Amazon was dropped by the Science Based Targets initiative (SBTi) as a validated company, due to failure to reach agreement on commitments; concerns exist around Amazon’s reporting of Scope 3 emissions, and accounting for renewables. The fact that the biggest webscaler is no longer officially validated with SBTi is a disappointment, but also a reminder that sustainability reporting is a nascent field and data cannot always be relied upon.

US accounts for over 50% of webscale capex

This report series traditionally breaks out revenues by region for each webscaler. With the previous edition of the report, we added our first regional breakout of capex, focused on the US. Our analysis finds that the US has amounted to between 50-60% of global webscale capex for most of the last decade. This percentage increased in the last two years, ending 2022 at an incredible 65%. Some of this growth is due to a capex surge by US-centric Amazon in 2021-22. We don’t expect this dominance by the US to continue. The ratio is likely to return below 50% soon as webscalers expand their footprints in other regions. Spending pickups by China-based cloud providers will be one driver of this moderation.

Webscale market compared to telecom

A decade ago, the webscale sector did not exist. Big tech companies were just beginning to build their own data centers to optimize their cost structure, operational efficiency, and time to market. But webscale capex was a rounding error in the overall market for network infrastructure. That’s not the case anymore. Webscale capex surpassed $200B for the first time in 2022. Annualized webscale capex has since fallen below $200B, but that is a short-term blip.

Telco capex is still higher, and will remain so for the next few years. But, webscale capex is far more concentrated, as it is dominated by a few big spenders, and it is focused on a smaller range of product types and vendors. Some aspects of webscale capex are more leading edge; innovations in the data center often impact other types of networks (e.g. high-speed optics for telco backbone networks). As such, the market will continue to be important for lots of vendors – and not just chip suppliers.

Spending outlook

Here is a summary of the spending outlook for key webscalers:

Amazon (28.6% of annualized global webscale capex): Expects CY23 “capital investments (capex plus finance leases) to be approximately $50 billion compared to $59 billion in 2022. We expect fulfillment and transportation CapEx to be down year-over-year, partially offset by increased infrastructure CapEx to support growth of our AWS business, including additional investments related to generative AI and large language model efforts.”

Microsoft (16.6%): “[In 4Q23] we expect capital expenditures to increase sequentially on a dollar basis, driven by investments in our cloud and AI infrastructure. As a reminder, there can be normal quarterly spend variability in the timing of our cloud infrastructure buildout…”

Alphabet (15.0%): References AI as driver, like most webscalers. “We do continue to expect elevated levels of investment in our technical infrastructure. It will be increasing in the fourth quarter. 2024 aggregate CapEx will be above the full year 2023″

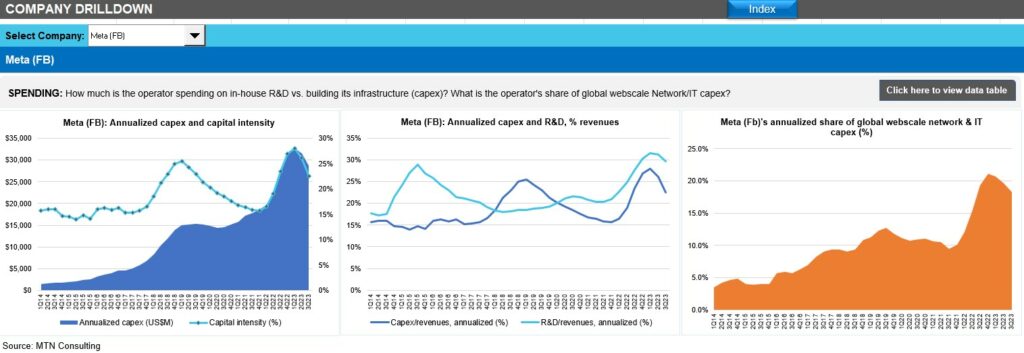

Meta (FB) (14.9%): “We expect 2023 capital expenditures to be in the range of $27 billion to $29 billion, updated from our prior estimate of $27 billion to $30 billion. We anticipate our full year 2024 capital expenditures will be in the range of $30 billion to $35 billion, with growth driven by investments in servers, including both non-AI and AI hardware, and in data centers as we ramp up construction on sites with the new data center architecture we announced late last year.”

Apple (5.7%): no guidance.

Oracle (4.3%): “Capital expenditures were $8.3 billion over the last 4 quarters, and we’re clearly beginning to see the cash flow benefits stemming from our cloud transformation…Given the demand we have and see in the pipeline, I expect that fiscal year 2024 CapEx will be similar to this past year’s CapEx…We now have 64 cloud regions live with 44 public cloud regions around the world and another 6 being built…”

Alibaba (1.7%) – no guidance. Just decided to cancel spinoff of cloud unit, suggesting some delay in buildout plans. Believes the “growth opportunity driven by AI services have just begun.”

Baidu (0.7%): no guidance, but is bullish on its generative AI platform, ERNIE. Baidu says it is “empowering cloud customers to build their transformative products and services using ERNIE bot.

eBay (0.3%): capex will remain in the 4-6% of revenue range.

Forecast update

Our latest official forecast for the webscale market calls for $218B of 2023 capex. This target is 5-10% too high. However, the tech portion of webscale capex is higher than expected, helping to offset the top-line forecast underperformance. Moreover, data center spend by webscalers is moderating, not crashing. Rising interest rates are the main factor in this gap, as several companies point specifically to high borrowing costs as enticing them to moderate the pace of buildouts. The effect is small so far, though, and many other positive factors are driving investment; GenAI in particular. MTN Consulting will formally update its projections for the webscale market in December 2023.

- Table Of Contents

- Figures & Charts

- Coverage

- Visuals

Table Of Contents

- Abstract

- Analysis

- WNO Market: Key Stats

- Company Drilldown

- Top 8 WNOs

- Company Benchmarking

- Regional Breakouts

- Raw Data

- Exchange Rates

- About

Figures & Charts

- Key Metrics: Growth rates, Annualized 3Q23/3Q22 vs. 2011-22

- WNO Revenues: Single-quarter & annualized (US$M)

- Top 8 WNOs: YoY revenue growth in 3Q23

- Annualized profitability: WNOs

- Free cash flow per employee, 3Q23 annualized (US$)

- FCF Margins vs. Net Margins, 3Q23 annualized

- Advertising revenues as % total (FY2022)

- Annualized capex and R&D spending: WNOs (% revenues)

- WNO capex by type, Annualized: 3Q15-3Q23 (US$M)

- Network & IT capex as share of revenues, 3Q23 annualized

- R&D expenses as % revenues, Top 8 WNOs (3Q23 annualized)

- Acquisition spending vs. capex spending, annualized (US$M)

- Net PP&E per employee (US$’ 000) – 3Q23

- Ranking the Webscale Network Operators: Revenues; R&D; Capex; Network & IT capex – 2022 & 3Q23 (US$B)

- Annualized spending share for key webscalers since 2011 Capex: Network, IT and software

- Share of webscale spending by company, 3Q23 and 3Q22 annualized (Capex: Network, IT and software)

- Energy consumption vs. Net PP&E for key webscalers in 2022

- USA: Webscale capex total ($M) and % of global market, 2011-22

- Webscale vs. Telco Market: Annualized Capex (US$B)

- Webscale vs. Telco Market: Annualized capital intensity

- Revenues: annual, single-quarter, and annualized (US$M)

- Profitability (Net Profit; Cash from operations; Free cash flow): annual, single-quarter, and annualized (US$M)

- Spending (R&D; M&A; Capex; Network & IT capex; Lease): annual, single-quarter, and annualized (US$M)

- Cash & Short-term Investments: annual and single-quarter (US$M)

- Debt (Total debt; Net debt): annual and single-quarter (US$M)

- Property, Plant & Equipment: annual and single-quarter (US$M)

- Key Ratios: Net margin; R&D/revenues; Capex/revenues; Network & IT capex/revenues; Free cash flow/revenues; Lease costs/revenues – annual and annualized (%)

- Total employees

- Revenue per employee, annualized (US$K)

- FCF per employee, annualized (US$K)

- Net PP&E per employee, annualized (US$K)

- Revenues & Spending (US$M)

- Webscale Business Mix by Revenues (FY2022) – MTN Consulting estimates

- Top 10 recent acquisitions & investments

- Data center footprint

- Revenues (US$M) & YoY revenue growth (%), single-quarter: by company

- Revenues, annualized (US$M): by company

- Annualized profitability margins: by company

- Annualized capex and capital intensity: by company

- Annualized capex and R&D spending as % of revenues: by company

- Share of WNO network & IT capex, Annualized: by company

- Total employees: by company

- Annualized per-employee metrics (US$000s): by company

- Net debt (debt minus cash & stock) (US$M): by company

- 2011 vs. 2022: company benchmark by KPI (Revenues, R&D, Net profit, Cash from operations, Capex, Free cash flow, Cash & short-term investments, Net PP&E, Total debt)

- 2011 vs. 2022: company benchmark by key ratio (Capex/revenues; R&D/revenues; Net margin; FCF margin)

- Top 8 WNO’s share vs. Rest of the market: by KPI (Revenues, R&D, Net profit, Cash from operations, Capex, Free cash flow, Cash & short-term investments, Net PP&E, Total debt)

- Top 8 WNOs benchmarking by Key ratio: Capex/revenues; R&D/revenues; Net margin; FCF margin)

- Total WNO Market Revenues, by region: Latest CY; Latest Quarter; Annual trend (2011-22); Single quarter (3Q15-3Q23 )

- WNO Market: Revenues, single-quarter (YoY % change)

- Regional revenues by operator: Latest CY; Latest Quarter; Annual trend (2011-22); Single quarter (3Q15-3Q23)

- Top 10 operators by region: Latest CY; Latest Quarter

Coverage

| Top 8 WNOs | |||

| Alibaba | Alphabet | Amazon | Apple |

| Baidu | Meta (FB) | Microsoft | Tencent |

| Other WNOs | |||

| Altaba | ChinaCache | Cognizant | eBay |

| Fujitsu | HPE | IBM | JD.com |

| Oracle | SAP | ||

| Yandex | |||

Visuals