Telcos are upgrading their workforce, but it comes at a price

One of the many telecom stats we track is “labor costs”, i.e. what telcos spend in salaries and benefits to support their workforce. Not a lot of other analyst firms track labor costs, if any. It’s not an easy one to track, as telcos aren’t required to report it, and the data can be hidden. But it is essential to understanding the telco’s business and challenges they face.

What’s important to know about labor costs and the telco workforce in general?

Labor costs represent a lot of money. The capex spent by telcos on their networks gets lots of attention, and for good reason. It’s a huge cost, at roughly 17% of revenues across the globe. Yet spending on the workforce is nearly as much as capex. In 2021, telco capex was $326 billion (B), while labor costs totaled $273B. Some telcos spend significantly more on labor costs than capex. Saudi Telecom (stc), for instance, spent $2.6B on labor costs in 2021, 60% more than that year’s $1.6B capex figure for the company. The labor cost to capex ratio exceeded 1 for a number of other large telcos in 2021, including: Chunghwa (1.26), Orange (1.10), Singtel (1.2), Telecom Argentina (1.20), Telefonica (1.23), and Telstra (1.26).

Labor costs are not just salaries. When we say “labor costs”, we mean to capture the fully-loaded cost of an employee. That includes salaries and wages, short-term benefits, retirement benefits, any required government contributions, and share-based compensation. Labor costs are around 20-60% more than just direct salaries, depending on the company. Some companies report the breakout of the various categories, but many do not. For Verizon and AT&T, we estimate the labor cost to salary ratio as 1.4.

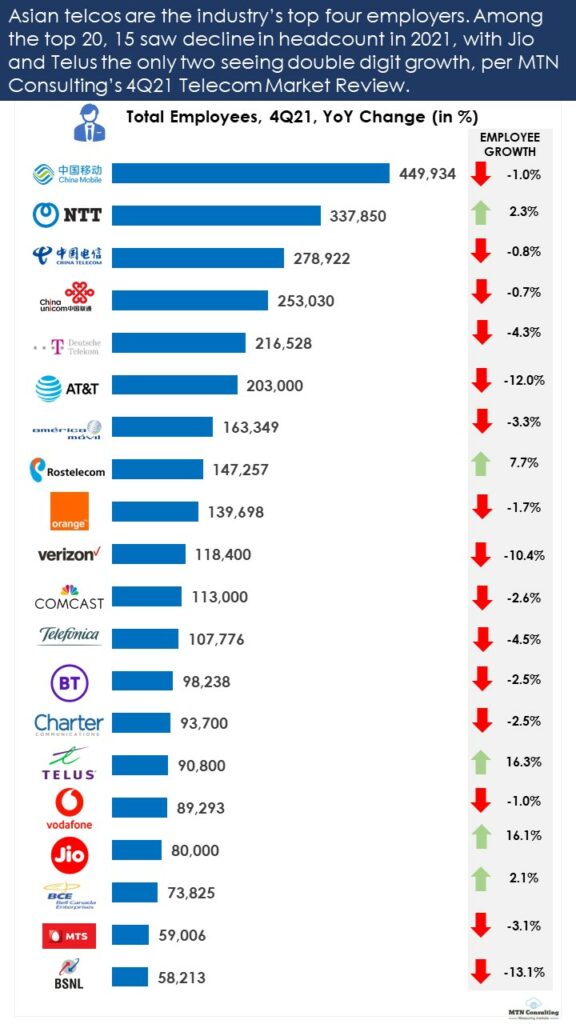

Headcount is falling. As MTN Consulting detailed in its 4Q21 market review for the telco sector, headcount in the telco industry continued to fall last year. Total employees dropped 2% in 2021, to 4.69 million. Only 5 of the top 20 telcos increased headcount in 2021. The 2021 decline follows a much worse 3.7% drop for the industry in 2020, when COVID forced cutbacks, office closures and acceleration of timelines for digital transformation and automation programs. Prior to COVID, telcos were already in staff-cutting mode, but COVID sped up the process. Looking down the road a bit, telco headcount should fall to ~4.4M by 2026. Figure 1 illustrates changes in 2021 for the top 20 telco employers.

Figure 1: Total employees and YoY % change of top 20 telcos, 2021

Source: MTN Consulting

Labor cost per employee is rising. Amidst this drop in headcount, average labor costs have been rising. From $49.2K in 2017, the average telco employee in 2021 cost $57.6K, or 17% more. Prior to 2018, labor costs per employee were flat for most of the last decade, hovering around US$50K per employee. The inflationary pressures of late 2021 may have played a small role, but more important is the changing nature of a telco. With deployment of software-based platforms in the network, and digitization of a whole range of processes across the company, a different type of employee is required. Some may be younger, but their skills are in demand and can be costly. There is rising competition for these employee types, including from cloud providers like GCP and AWS.

Labor costs a large part of opex. The rising cost per employee is interesting, but even more important may be labor cost’s contribution to opex. As a percentage of opex, excluding the non-cash items of depreciation & amortization, labor costs can exceed 30%. That was the case for a number of large telcos in 2021, including BCE (labor costs equal to 32.6% of opex ex-D&A), BT (31.7%), KPN (30.8%), Swisscom (39.8%), and Telecom Italia (35.9%). Some of these companies face constraints in how they structure their workforce, for instance, union rules limiting layoffs or locking in salary increases. On average, labor costs account for about 22% of opex ex-D&A.

The labor cost burden isn’t equal across markets. Telcos across the globe face similar price levels for their technology inputs. Prices vary somewhat, of course, but the variation is rarely on the order of 3-5x. More important is the variation in technology choices made across different markets, and the way they finance capex. For labor costs, though, the variation in the cost of an employee can be huge. Labor markets are highly localized, even with a more remote/hybrid workforce than in the past. The average employee at UAE-based Du, for instance, cost US$199.8K in 2021, nearly 6x that of another UAE-based telco, Etisalat ($34.0K). The reason for that is most of Etisalat’s workforce is in lower cost countries such as Pakistan, Egypt, and Morocco, whereas Du operates solely out of high-cost UAE.

Telcos investing in upskilling. As telcos deploy more software in their networks and digitally transform all aspects of their operations (including sales & customer support), many are investing heavily in upskilling their employee base. Vodafone, for instance, says “the transformation into a new generation connectivity and digital services provider requires new skills and capabilities in our organization, such as software engineering, automation and data analysis.” Vodafone invested an average of 470 Euros in FY2021 on “training each employee to build future capabilities.” Similar things are occurring at many other telcos, including Deutsche Telekom, which is investing in “upskilling and reskilling programs with a focus on digital skills”. There is also a growing focus on hiring younger employees with skills more appropriate to the digital age.

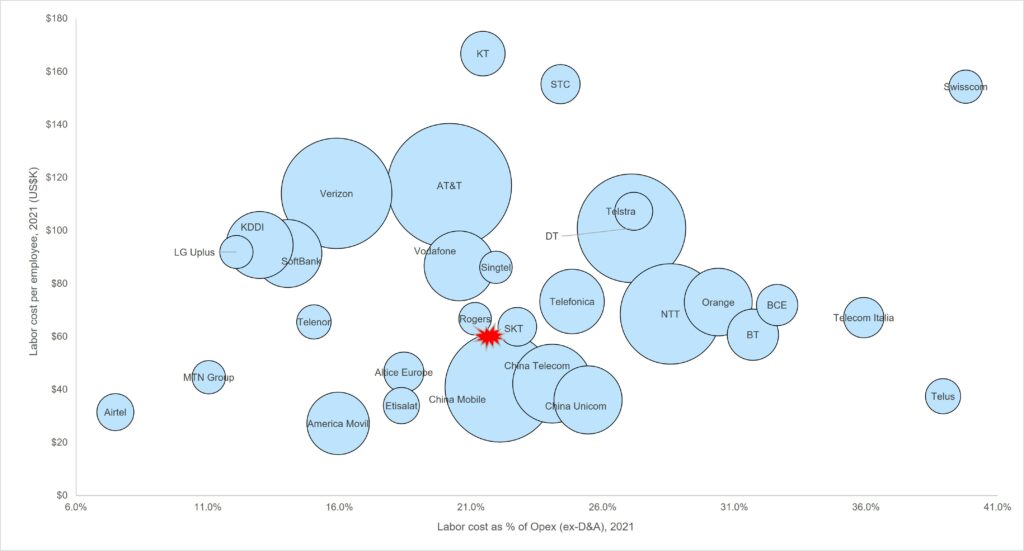

Propensity to adopt automation varies widely. Vendors talk a lot about how their solutions allow customers to do more with less: automate tasks and processes which previously required manual intervention. This has always been a part of the telecom industry, from the days when telcos migrated away from manual telephone switchboards. It continues to be important as telcos aim to lower their cost of operations, deploy services more rapidly, and maintain network quality. The importance of automation varies widely across country and operator, however. Companies which face high unit labor costs tend to be more eager to adopt automation, all else equal. When labor costs are a relatively high portion of overall opex, that eagerness multiplies. Figure 2 below illustrates the issue.

Figure 2: Labor cost burden variation across 30 large telcos, 2021

Source: MTN Consulting

Notes: Size of bubble is indicator of relative revenues. Red star icon represents the global average.

For 30 large telcos, the above figure shows labor cost as a % of opex (ex-D&A) on the x-axis, and labor cost per employee on the y-axis. The companies in the top right quadrant tend to be more open to automation, while the bottom left (low labor costs) are the opposite. Swisscom is a bit of an outlier, as its labor costs are so high. That’s a reason for Swisscom’s adoption of Red Hat’s Ansible Automation Platform in 2018, for instance. Other big telcos with an economic inclination to automate include: Telefonica, DT, Telstra, NTT, Orange, BT, BCE, and Telecom Italia.

One thing that telcos won’t be automating anytime soon is the CEO. The top few managers in many leading telcos continue to earn millions of US$ per year, and there often seems to be little relationship between these sky-high pay packages and the company’s performance. Light Reading detailed this situation recently in an insightful article. LR notes that the ratio of CEOs’ pay packages with the median employee in 2021 was 312:1 for T-Mobile, 231:1 for AT&T, 166:1 for Verizon, and 106:1 for Telefonica. Swisscom’s CEO Urs Schaeppi had to make do with a relatively paltry margin of 14:1.

*

Cover image credit: Scott Webb on Unsplash